“Accidental Fires” Continue To Happen At Food Processing Facilities All Over The United States

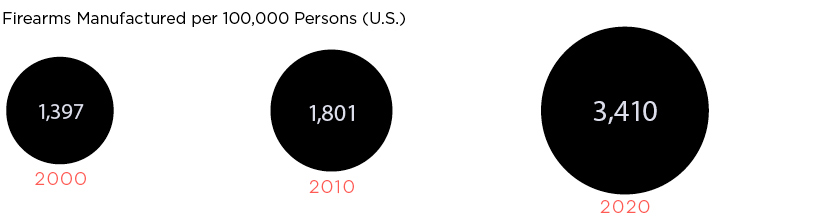

30 Years of Gun Manufacturing in America

While gun sales have been brisk in recent years, the uncertainty surrounding COVID-19 was a boon for the gun industry.

From 2010-2019, an average of 13 million guns were sold legally in the U.S. each year. In 2020 and 2021, annual gun sales sharply increased to 20 million.

On March 8, President Joe Biden declared, in a speech announcing a ban on imports of Russian oil and gas, that these and other actions taken by the United States government “to inflict further pain on [Russia President Vladimir Putin]” would “cost us as well, in the United States.” Since then, the US government’s economic sanctions on Russia — as well as spending, military training, intelligence sharing, and weapons transfers to attack the Russian military — have increased as the economic conditions in America have declined.