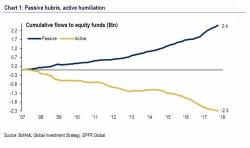

Bank Of America: "This Is The First Sign That A Bubble Has Arrived"

Lately, fund flow data has all the credibility of a NYT presidential poll two days before the Trump defeats Hillary. On one hand, you have Lipper reporting that investors pulled $16.2bn from U.S.-based equity funds in the past week, the largest withdrawals since December 2016. The same Lipper also reported that taxable-bond mutual funds and ETFs recorded $1.2bn in outflows, with U.S.-based high-yield junk bond funds posting outflows of $922 million.