Refugee Admissions Into U.S. Plunge 83% In First Two Months Of FY18

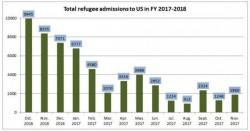

As monthly refugee admissions into the United States lap the last few months of Obama's administration, the stark changes enacted by the Trump White House are more apparent than ever with admissions down a staggering 83% in the first two months of fiscal 2018 (October and November) compared to the first two months of fiscal 2017.

As CNS News points out, a total of only 3,108 refugees were admitted in October and November down from the 18,300 refugees who were admitted in October and November of last year.