"Reading The News On America Should Scare Everyone, Every Day... But It Doesn't"

Authored by Raul Ilargi Meijer via The Automatic Earth blog,

Authored by Raul Ilargi Meijer via The Automatic Earth blog,

Authored by Darius Shahtahmasebi via TheAntiMedia.org,

Iranian officials have struck back at the Trump administration’s verbal attacks on Iran, suggesting the U.S. should worry about its own domestic problems before turning a critical eye towards them. According to al-Monitor, an arguably pro-Tehran media site:

Submitted by Ronan Manly, BullionStar.com

The COMEX gold futures market and the London OTC gold market have a joint monopoly on setting the international gold price. This is because these two markets generate the largest ‘gold’ trading volumes and have the highest ‘liquidity’. However, this price setting dominance is despite either of these two markets actually trading physical gold bars. Both markets merely trade different forms of derivatives of gold bars.

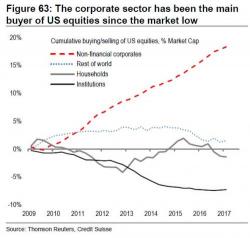

On Monday morning, we excerpted from the latest report by BofA's David Woo, who echoed a familiar lament when looking at the divergence between global political risk and the collapse in cross-asset volatility, concluding that he finds it "difficult to reconcile the record low volatility in financial markets at the moment with growing political risk in Washington and geopolitical risk in Asia.

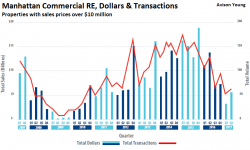

In the second quarter in Manhattan, Chinese entities accounted for half of the commercial real estate purchases with prices over $10 million. By comparison, in 2011 through 2014, total cross-border purchases from all over the world (not just from China) were in the mid-20% range.

“At a time when domestic investors have pulled back, foreign parties have ramped up their holdings in Manhattan,” according to Avison Young’s Second Quarter Manhattan Market Report.