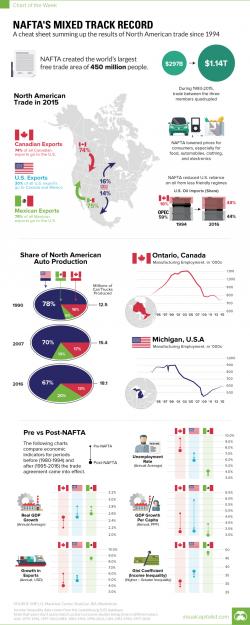

Visualizing NAFTA's Mixed Track Record Since 1994

On January 1, 1994, the North American Free Trade Agreement (NAFTA) officially came into effect, virtually eliminating all tariffs and trade restrictions between the United States, Canada, and Mexico. As Visual Capitalist's Jeff Desjardins reminds readers: