Jim Rogers Buying Gold Bullion On Dips

Jim Rogers Buying Gold Bullion On Dips

Jim Rogers Buying Gold Bullion On Dips

European, Asian stocks declined, halting a global rally that sent U.S. stocks surging to new all time highs faltered, weighing on the S&P although the index rebounded modestly after a kneejerk announcement lower overnight after Trump's National Security Advisor announced his unexpected resignation.

As many had expected, multiple sources have now confirmed that former General Mike Flynn has resigned from his role as President Trump's national security advisor. The White House has confirmed that Lt. General Joseph Keith Kellogg, Jr. has been appointed Acting National Security Advisor.

President Donald J. Trump Names Lt. General Joseph Keith Kellogg, Jr. as Acting National Security Advisor, Accepts Resignation of Lt. General Michael Flynn

Since November 8th, several public companies have unsuspectingly fallen into the cross hairs of Trump tweets sending their stocks gyrating violently while adding or erasing millions of dollars worth of market cap in a matter of seconds. Here is just a small sample:

Toyota Motor said will build a new plant in Baja, Mexico, to build Corolla cars for U.S. NO WAY! Build plant in U.S. or pay big border tax.

— Donald J. Trump (@realDonaldTrump) January 5, 2017

Submitted by Thorstein Polleit via The Mises Institute,

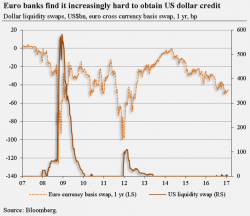

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.