Gross: "Without QE From ECB And BOJ, The U.S. Economy Would Sink Into Recession"

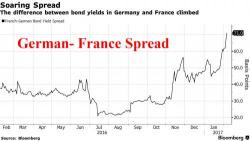

Back in November, when describing the perverse global fund flows in which record money creation out of the BOJ and ECB amounting to roughly $200 billion per month was being used indirectly, via spread differentials, to create demand for US Treasuries by foreign official and private investors - an observation first made by Deutsche Bank - we dubbed it "global helicopter money", and were surprised that "nobody has noticed" what is going on.