The Shocking Truth About How Barack Obama Was Able To Prop Up The U.S. Economy

Submitted by Michael Snyder via The Economic Collapse blog,

Submitted by Michael Snyder via The Economic Collapse blog,

With Carrier setting the precedent for what future negotiations with the Trump administration may look like, Ford CEO Mark Fields has come forward to layout potential policy changes that would be important to preserving auto jobs in the United States. Not surprisingly, per an interview with Bloomberg, Fields' opening "ask" focused on less restrictive fuel economy standards, new currency-manipulation rules to promote free and fair trade and corporate tax reform.

Submitted by Alasdair Macleod via GoldMoney.com,

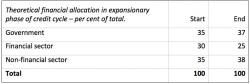

The Trump shock produced some unexpected market reactions, partly explained by investors buying into a risk-on argument,equities over bonds and buying dollars by selling other currencies and gold.

Via The Daily Bell

Kentucky Senator Rand Paul has been on the warpath when it comes to President-elect Donald Trump’s secretary of state picks. He’s not been one to hold back commentary about former ambassador to the U.N. John Bolton, calling him a “menace,” and vowing that if Trump decided to go with Bolton, the Senator would gather the necessary votes to stop it. -The Blaze

Is the US Government Behind the Fake News Media Attacks on President-elect Trump?

Paul Craig Roberts

Eric Zuesse has brought to our attention that US intelligence officials have placed a story in Buzzfeed, “a Democratic party mouthpiece,” that the Russian government used fake news to get Donald Trump elected president. http://www.washingtonsblog.com/2016/12/63755.html

According to Buzzfeed: