12 Signs Of Extreme Optimism In America Now That Donald Trump Has Been Elected

Submitted by Michael Snyder via The End of The American Dream blog,

Submitted by Michael Snyder via The End of The American Dream blog,

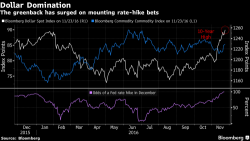

While most global equity markets were subdued due to the US Thaksgiving holiday, the FX world was very busy overnight, marked by the relentless dollar surge on expectations of a rate hike not only in December but further in 2017, sending Asian currencies to the weakest level in 7 years: the Bloomberg-JPMorgan Asia Dollar Index reached 103.32, the lowest level since March 2009.

Hold your real assets outside of the banking system in one of many private international facilities --> https://www.sprottmoney.com/intlstorage

Louis Cammarosano: Interconnectedness of Silver Eagles and India’s War on Cash

Posted with permission and written by Rory Hall, The Daily Coin (CLICK HERE FOR ORIGINAL)

IHS Markit today released their annual study on the average age of light vehicles registered in the U.S.. As expected, the average fleet age continues to tick up and currently stands at 11.6 years. While this may be great news for consumers, higher quality and longer useful lives can have a detrimental impact on annual auto sales.

“Quality of new vehicles continues to be a key driver of the rising average vehicle age over time,” Mark Seng, global automotive aftermarket practice director at IHS Markit, said in a statement.

The day after Thanksgiving, also known as Black Friday, is when the holiday shopping season in the United States traditionally begins and is the day when retailers (at least in the past) finally turned a profit, going from “being in the red” to “in the black.” However, in recent years, this trend has seen turned upside down, with sales on Black Friday slipping, as retailers offer pre-Thanksgiving deals ever earlier than in recent years to capture heavily discounted market share (think OPEC) and draw shoppers as "Black Friday" no longer marks the spending peak at brick-and-mortar chains.