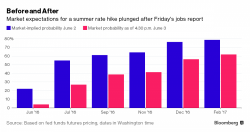

Futures Flat Following Friday's Jobs Fiasco: All Eyes On Yellen Again

Every ugly nonfarm payrolls has a silver lining, and sure enough following Friday's disastrous jobs report, global mining and energy companies rallied alongside commodities after the jobs data crushed speculation the Fed would raise interest rates this month. “The disappointing U.S. jobs report on Friday means that a summer Fed rate hike is off the table,” said Jens Pedersen, a commodities analyst at Danske Bank. “That has reversed the upwards trend in the dollar, supporting commodities on a broader basis.