These Are The Two Most Important Questions Facing The Market

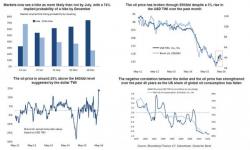

With the S&P500, seemingly unable to break decisively above 2090, investors are wondering what are the main catalysts that can push the market higher, and are asking questions. To help with the confusion, Deutsche Bank has laid out the top five recurring questions asked by investors who are trying to figure out what will push stocks higher. Among these are whether European (and global) equities will rally as Brexit fears are being priced out; is there scope for earnings upgrades and will value stocks finally start outperforming.