Global Stocks, US Futures Slide On Mediocre Manufacturing Data, Yen Surge

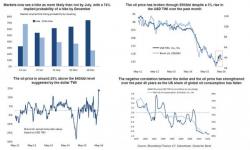

Following the latest set of global economic news, most notably a mediocre set of Chinese Official and Caixin PMIs, coupled with a mix of lackluster European manufacturing reports and an abysmal Japanese PMI, European, Asian stocks and U.S. stock index futures have continued yesterday's losses. Oil slips for 4th day, heading for the longest run of declines since April, as OPEC ministers gather in Vienna ahead of a meeting on Thursday to discuss production policy.