Two Trends That Will Force The Fed To Start Buying Stocks

Authored by John Rubino via DollarCollapse.com,

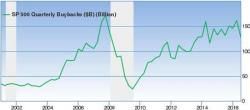

While the Japanese and Swiss central banks have turned themselves into hedge funds by loading up on equities, the US Fed has stuck to supporting the stock market indirectly, by buying bonds. It’s worked, obviously, with all major US indexes at record highs. But it won’t work going forward, thanks to two gathering trends.