Gold Gains As Stock Market Volatility Collapses To 10-Year Lows

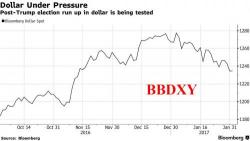

Gold is up, stocks are dead, vol is dead, bonds are flat, mcro data is disappointing, and Trump is rattling sabres...

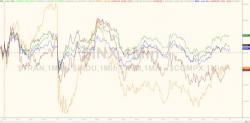

Small Caps and Trannies remain red post-Fed, Dow, Nasdaq and S&P are barely green...