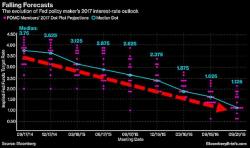

Fed Hikes Rates For First Time In 2016, Increases Pace Of Rate 'Normalization' Forecast

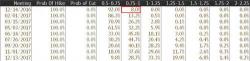

With 100% chance of at least a 25bps hike (and 10% chance of 50bps), this was perhaps the most 'priced in' of any Fed meeting ever. Of course, it is not whether the Fed hikes or not at a given meeting that matters, but rather what kind of overall hiking cycle it communicates, and so attention is focused on changes to the 'dot-plot'. No surprise here: FED RAISES RATES BY 25 BPS, REPEATS GRADUAL POLICY PATH PLAN, but the forecast is more hawkish: FED OFFICIALS SEE THREE 2017 RATE HIKES VS TWO IN SEPT.