Published

21 hours ago

on

September 9, 2025

| 30 views

-->

By

Julia Wendling

Graphics & Design

- Zack Aboulazm

The following content is sponsored by Global X

3 Things to Know About Covered Call Options

Covered call option ETFs offer investors a unique way to generate income. But what exactly are they, and when do they tend to perform best?

In partnership with Global X, this visualization breaks down the case for covered calls. It provides clear visual context to help investors better understand their role in a portfolio.

What Are Covered Call Options?

To begin, let’s break down a few key definitions. A call option is a contract that gives the buyer the right to purchase a stock at a set price before a certain date. Importantly, you don’t need to own the underlying stock in order to sell a call option.

A covered call option, on the other hand, is when you sell a call option on a stock you already own. For example, if you hold shares of Apple and choose to sell a call option on those shares, that position is considered a covered call.

Finally, a covered call ETF is a fund that holds a portfolio of stocks. The fund provider then sells call options on those holdings to generate additional income.

With these definitions in mind, what are three reasons to consider investing in covered calls in today’s market environment?

Reason 1: Enhanced Income Potential

One of the primary appeals of covered call ETFs is their ability to generate additional income through option premiums. Even when stock prices remain flat and capital gains are limited, investors can still earn consistent cash flow from the premiums collected.

This makes covered call strategies especially attractive in environments where traditional income sources, like bonds or dividends, may be less reliable.

Reason 2: Mitigated Downside Risk if the Market Falls

While owning stocks outright exposes investors to both the upside and downside of the market, covered call strategies provide a built-in cushion. By selling calls, investors receive premium income that can help offset some of the losses if stock prices fall.

Covered calls don’t eliminate downside risk entirely. However, the added layer of income can soften the blow during periods of market loss.

Reason 3: Improved Diversification

Covered call ETFs can also enhance portfolio diversification. Instead of relying solely on stock appreciation or dividends, investors benefit from an additional income stream through option premiums. This creates a more balanced return profile that combines both equity exposure and options-based income.

By blending these elements, covered call strategies can play a complementary role alongside traditional holdings, helping investors navigate different market conditions with greater flexibility.

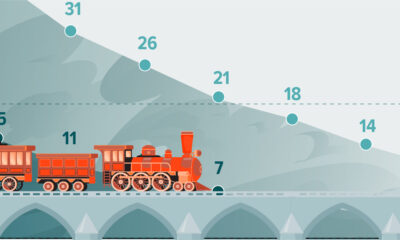

The Opportunity

The market’s exponential growth may be running out of steam—but covered calls offer a way to keep generating income, even as stocks lose momentum. By balancing equity exposure with option premiums, they provide investors with a strategy that could thrive in a slower, more uncertain market environment.

Learn more about the Global X Nasdaq 100 Covered Call UCITS ETF (QYLD) and the Global X S&P 500 Covered Call UCITS ETF (XYLU).

More from Global X

-

Markets21 hours ago

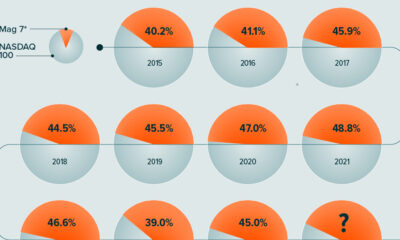

Visualised: Magnificent 7 Concentration in the Nasdaq 100 Over Time

The Nasdaq 100, a key benchmark for U.S. technology companies, is remarkably concentrated. Just seven stocks make up nearly 40% of the entire index.

-

Markets21 hours ago

Charted: A Slow-Growth Era for the S&P 500?

The S&P 500 surged in 2023 and 2024, and is on track for nearly 10% gains in 2025—but how long can the rally last?

-

Economy2 months ago

Ranked: Which European Sectors Need the Most Investment?

European infrastructure is under pressure—but not all sectors are being hit equally. Which ones need the most investment in coming years?

-

Economy2 months ago

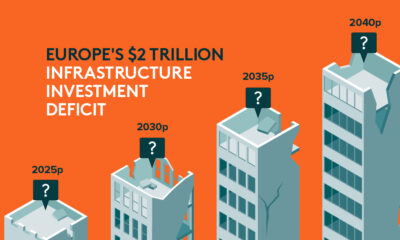

Charted: Europe’s $2 Trillion Infrastructure Investment Deficit

This graphic, created in partnership with Global X, offers visual context to Europe’s widening infrastructure investment gap, using data from Infrastructure Outlook.

-

Economy2 months ago

Breaking Down the €286 EU Billion Infrastructure Spend

This visualization, created in partnership with Global X, offers a clear look at where RRF grants and loans are being directed in the EU, based on…

-

Politics2 months ago

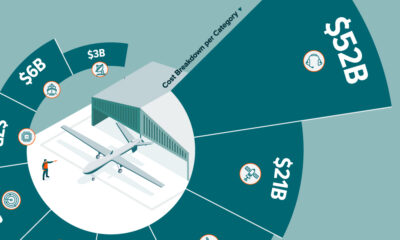

Breaking Down the West’s $146 Billion 2024 Defence Technology Investment

Visual Capitalist has partnered with Global X ETFs to break down the $146 billion spent on defence technology by the U.S. and the EU.

-

Politics2 months ago

Mapped: How NATO Defence Spending Has Changed Since the Ukraine-Russia War

Visual Capitalist has partnered with Global X ETFs to explore how NATO defence spending has changed since the start of the Ukrain-Russia war.

-

Politics2 months ago

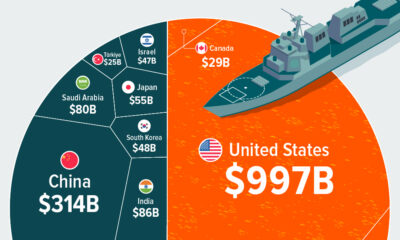

Visualized: Global Defence Spending in 2024

Visual Capitalist has partnered with Global X ETFs to explore global defence spending and find out which nation spends the most on defence.

-

Economy3 months ago

Breaking Down the 117th Congress’s $1.2T Infrastructure Investment

Graphic showing U.S. infrastructure investment highlighting that investment is primarily going to roads, bridges, and other major projects.

-

Economy3 months ago

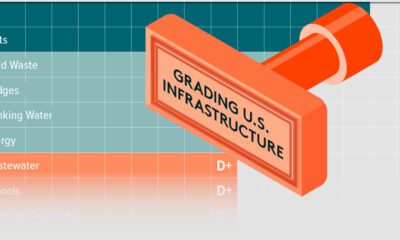

Report Card: Grading U.S. Infrastructure

This graphic shows U.S infrastructure grades and highlights the general low grade.

-

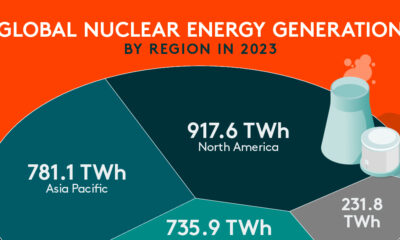

Energy8 months ago

Nuclear Energy Supply Forecast by Region

Visual Capitalist and Global X partnered to explore global nuclear energy demand, and how it’s changing, in the coming years.

-

Energy8 months ago

Charted: $300 Billion in Global Nuclear Energy Investment

Visual Capitalist and Global X partnered to explore nuclear energy investment and find out which regions spent the most on nuclear power.

-

Energy8 months ago

Visualized: Nuclear Energy Generation by Region

Visual Capitalist and Global X ETFs explore regional nuclear energy generation and why nuclear energy is critical to the energy transition.

-

Technology10 months ago

Ranked: Which Countries Have the Most Data Centers?

For this graphic, Visual Capitalist partnered with Global X ETFs to rank the nations by the number of data centers they currently operate.

-

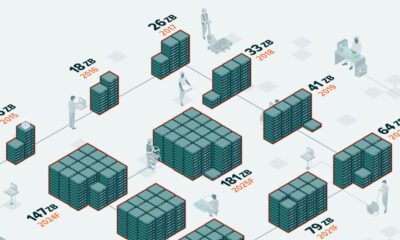

Technology10 months ago

Charted: How Much Data is Stored Online?

For this graphic, Visual Capitalist has partnered with Global X ETFs to explore online data generation and show how much data could be generated between 2015…

-

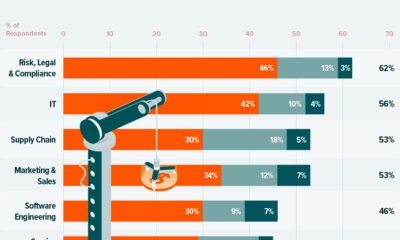

Technology10 months ago

Visualized: The Impact of AI on Revenue

In this graphic, Visual Capitalist has partnered with Global X ETFs to explore the financial impact of AI adoption across various industries.

-

Green2 years ago

Mapped: U.S. Investment in Sustainable Infrastructure (2021-2023)

This graphic shows high levels of investment in U.S. clean infrastructure between 2021 and 2023.

-

Technology2 years ago

Visualized: What is the Artificial Intelligence of Things?

Explore the explosive growth of the Artificial Intelligence of Things (AIoT) industry and its transformative impact across sectors.

-

Technology2 years ago

A Visual Guide to AI Adoption, by Industry

AI adoption impacts many industries, with finance leading. Discover how AI tools optimize operations, mitigate risks, and drive growth.

-

Technology2 years ago

Ranked: Artificial Intelligence Startups, by Country

Find out which countries are winning the race when it comes to the number of AI startups and private investment .

-

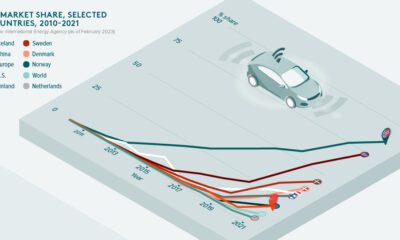

Technology3 years ago

On the Road to Electric Vehicles

Electric vehicles are playing a key role in the decarbonization of road transport. But how much further do we need to go to hit net zero?

-

Mining3 years ago

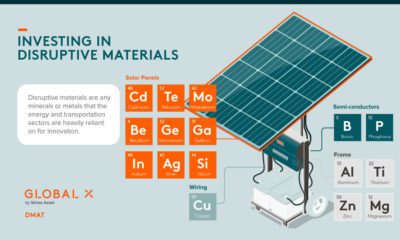

Should You Invest in Disruptive Materials?

Disruptive materials are experiencing a demand supercycle. See how these materials are helping revolutionize next generation technologies.

-

Technology3 years ago

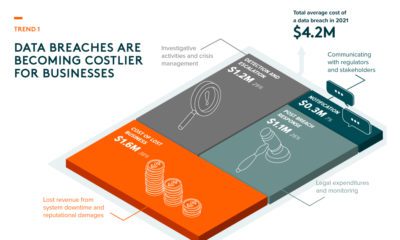

Thematic Investing: 3 Key Trends in Cybersecurity

Cyberattacks are becoming more frequent and sophisticated. Here’s what investors need to know about the future of cybersecurity.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up