Published

51 mins ago

on

July 11, 2025

| 11 views

-->

By

Julia Wendling

Article & Editing

- Alan Kennedy

Graphics & Design

- Athul Alexander

The following content is sponsored by Inigo Insurance

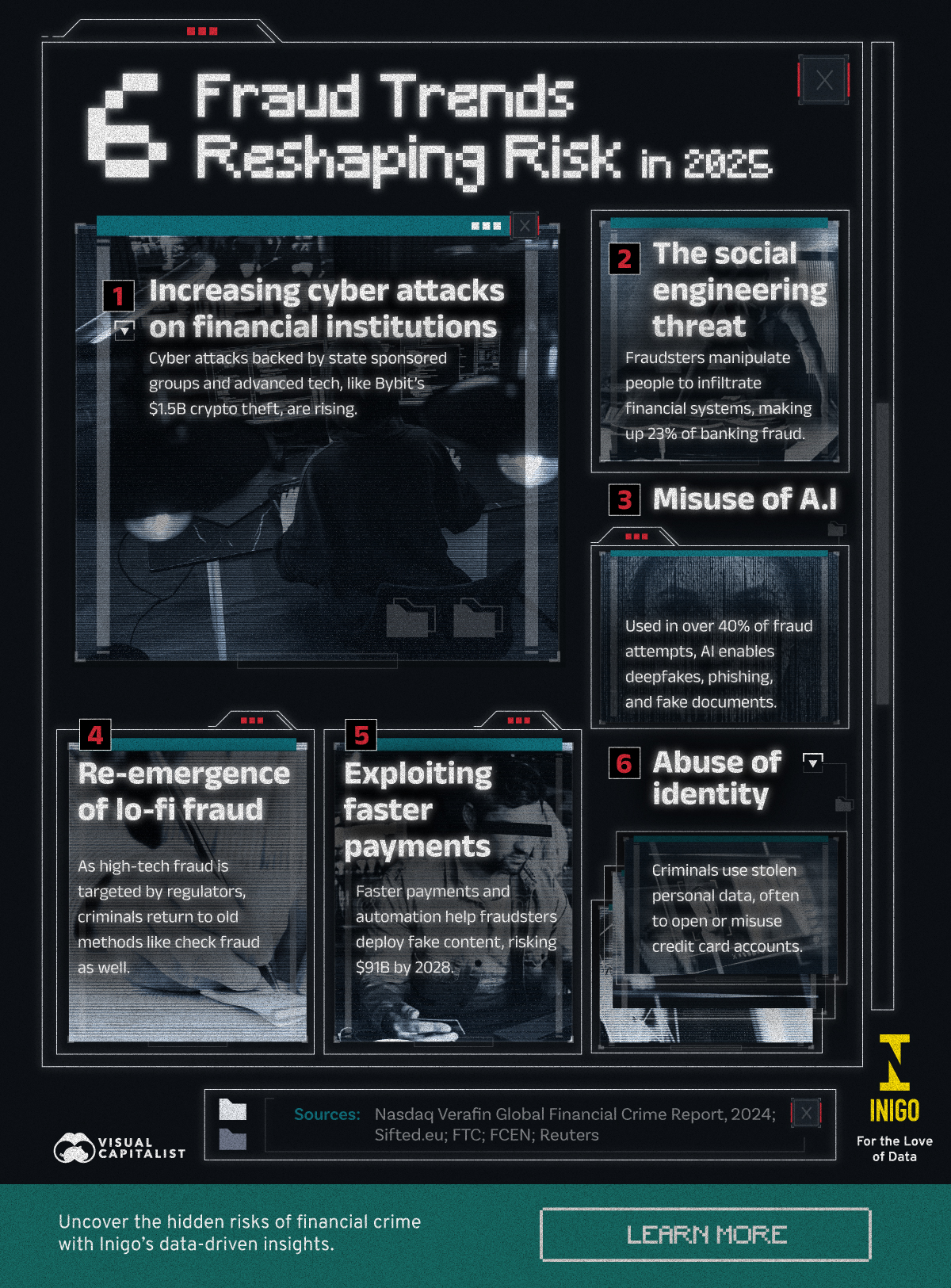

6 Fraud Trends Reshaping Risk in 2025

As technology—especially AI—becomes more widespread, fraud and financial crime are evolving just as rapidly. So, what are the key threats shaping the risk landscape in 2025?

This graphic, created in partnership with Inigo Insurance, highlights six major fraud trends to watch in the year ahead.

1. The Social Engineering Threat

Criminals are bypassing technical barriers by targeting people directly. Social engineering, which is a form of manipulation where fraudsters trick people into giving up confidential information, now accounts for 23% of banking fraud. This highlights the need for better awareness and training.

2. Misuse of Artificial Intelligence

AI is fueling a new wave of fraud as it enables perpetrators to orchestrate more sophisticated scams. Over 40% of attempts now use tools like deepfakes, phishing, and forged documents to deceive victims and systems alike.

3. Abuse of Identity

Stolen personal data is being exploited to open or misuse credit accounts, making identity theft a persistent and growing challenge for financial institutions.

4. Exploiting Faster Payments

Real-time payments and automation make it easier for fraudsters to spread fake content quickly—posing a $91 billion risk by 2028 if left unchecked.

5. Re-Emergence of Low-Fi Fraud

As regulators crack down on high-tech schemes, fraudsters are reviving old-school methods like check fraud that can still slip through the cracks.

6. Increasing Cyberattacks on Financial Institutions

Cyberattacks—often backed by foreign actors—are becoming more severe, as seen in major incidents like the $1.5 billion crypto theft from Bybit. As geopolitical tensions escalate around the world, this threat is one to watch in 2025.

Risks on the Horizon

As financial crime grows more sophisticated—combining emerging technologies with old-school scams—the need for a dynamic, up-to-date approach has never been greater. Inigo’s experts bring the data-driven insights needed to uncover hidden risks and help organizations stay one step ahead in an ever-shifting fraud landscape.

Visit Inigo for a data-driven view of risk.

More from Inigo Insurance

-

Cryptocurrency2 days ago

Ranked: The 10 Biggest Digital Heists

Some of the largest digital heists didn’t rely on brute-force hacking, they exploited the weakest link in security: human trust.

-

Crime3 days ago

The Most Costly Financial Crimes in 2024

As cybersecurity threats escalate, which financial crimes are causing the most harm? The FBI has the data.

-

Crime1 week ago

Mapped: U.S. Financial Crime Activity by State

Suspicious activity has been rising in the U.S., but is it spread evenly throughout all 50 states? Certainly not.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up