![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

Housing Affordability in the U.S., by Income Level (2019 vs. 2025)

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

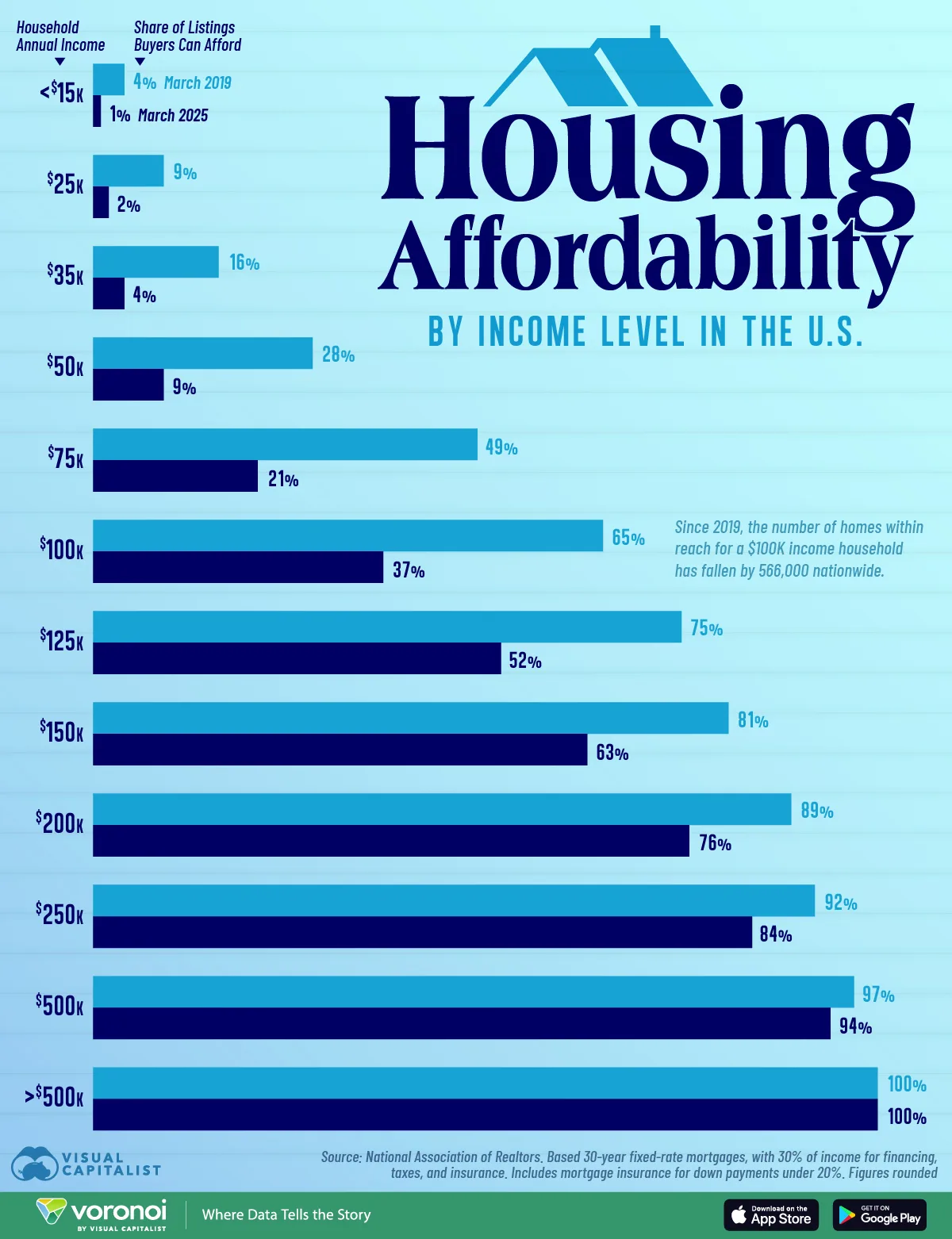

- Housing affordability has grown significantly out of reach for many Americans compared to 2019 given price growth and elevated mortgage rates.

- Households earning $100,000 have seen the share of affordable options contract from 65% of listings in 2019 to 37% in 2025.

Americans face a lack of affordable homes, even as for-sale inventory climbed 20% since 2024.

In the post-pandemic era, higher mortgage rates and a housing market boom have pushed many buyers out of the market. Today, households earning $75,000—a bracket often including professions liks teachers, nurses, and trades workers—can only afford 21% of listings, down from 49% in March 2019.

This graphic shows U.S. housing affordability by income level in 2025, based on data from the National Association of Realtors.

The State of Affordable Homes in 2025

For the analysis, affordability was determined using typical mortgage underwriting practices.

Specifically, it used a 30-year fixed-rate mortgage, with 30% of income for financing, taxes, and insurance. It also includes mortgage insurance for down payments under 20%.

| Household Income | Share of Listings Buyers Can Afford March 2025 | Share of Listings Buyers Can AffordMarch 2019 |

|---|---|---|

| Less than $15K | 1% | 4% |

| $25K | 2% | 9% |

| $35K | 4% | 16% |

| $50K | 9% | 28% |

| $75K | 21% | 49% |

| $100K | 37% | 65% |

| $125K | 52% | 75% |

| $150K | 63% | 81% |

| $200K | 76% | 89% |

| $250K | 84% | 92% |

| $500K | 94% | 97% |

| $500K+ | 100% | 100% |

As we can see, households earning $50,000 could afford 28% of listings in 2019, but now it has shrunk to just 9%.

Households earning $50,000 represent a third of the U.S. population, with homes under around $170,000 in their price range. Similarly, the share of affordable homes for many other lower-income households has contracted by at least three-quarters.

Yet even higher income households have seen notable contractions. In 2019, a household earning $150,000 could afford 82% of new listings, but now it has fallen to 62%. Ultimately, about 480,000 fewer listings are accessible to this income tier in just six years, based on a maximum affordable price of $510,000.

Learn More on the Voronoi App ![]()

To learn more about this topic, check out this graphic on North America’s least affordable housing markets in 2025.