Authored by Sven Henrich via NorthmanTrader.com,

I had an opportunity to speak with the Fast Money crew on CNBC last night about the Nasdaq and following the interview I received a bunch of questions via twitter and email. There’s only so much you can pack into a 4-5 min segment so I wanted to briefly expand a bit on the reasoning behind my position.

In last night’s segment I called the Nasdaq a beast, but one we were interested in fading knowing we are within the confines of continued upside risk in markets as I outlined in the recent “Final Wave“. Seasonality is generally positive in April and markets tend to have a very solid month before turning more shaky into May.

So why the thought of fading “the beast”?

Firstly for reference here’s the full clip of last night’s show including the FM crew’s comments:

https://player.cnbc.com/p/gZWlPC/cnbc_global

Firstly we talked about negative divergences. On the $NDX specifically we see recent new highs coming on lower relative strength, that’s a negative divergence:

I’ve drawn some basic fib retraces presuming current highs hold which we can’t be certain of, but it highlights the extent of the move since the November lows and how basically uncorrected it remains.

Why are negative divergences important? Because they signal underlying problems with a rally. In this case also note that new highs have continued to come with fewer and fewer of the $NDX components above their 50 day moving average:

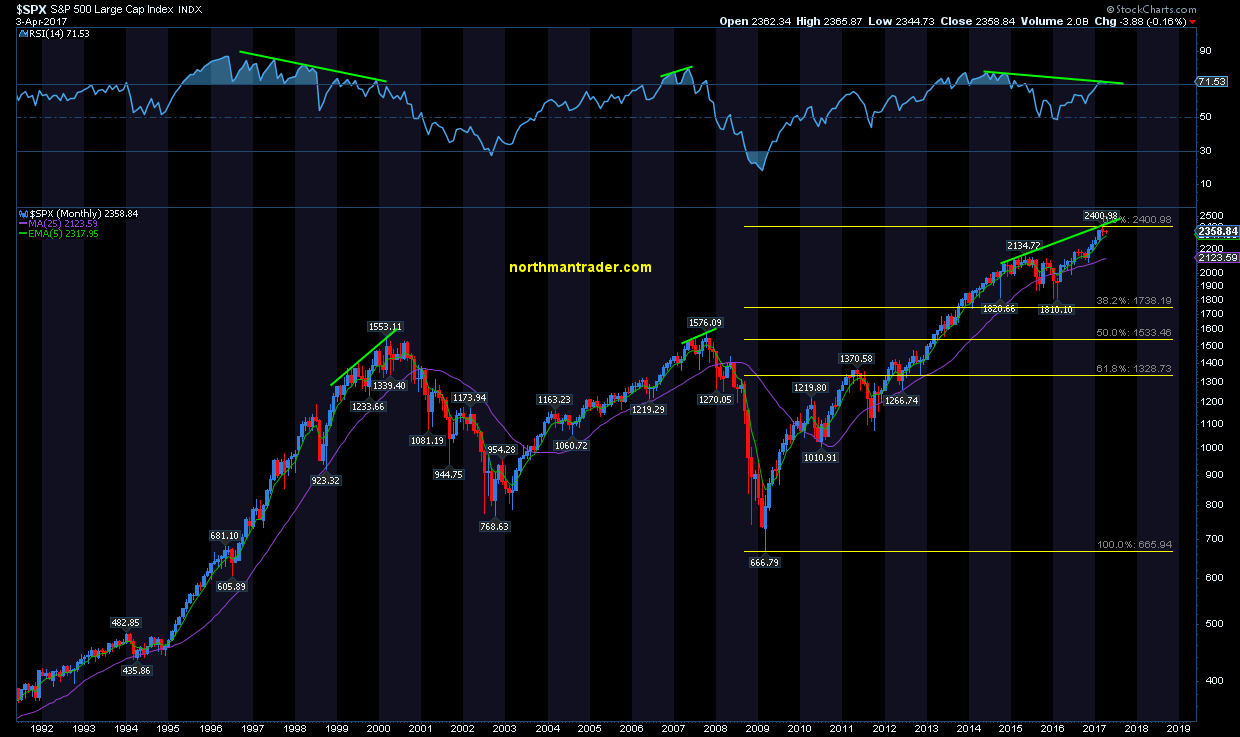

As I also outlined previously tops are processes and take quite a while to play out whereas bottoms tend to be more likely to be events. Take a long term chart of the $SPX as an example:

I also mentioned negative divergences on the $NDX and its components on multiple time frames.

Here is a monthly chart for example and note the resistance against a multi year trend line:

Similar divergences can be noted in individual stocks:

In addition, I mentioned large scale disconnects from longer term moving averages that make a reconnect at some stage ever more likely.

Finally i mentioned the $VIX. The pattern I discussed recently on Trading Nation is still active and I highlighted the 2 recent tags of the 200MA and note the tag again yesterday:

Is it a reasonable expectation to presume that the $VIX will never close above its 200MA in 2017? Frankly no. We are already in the historically most compressed time period in recent history with valuations at the very high end and mega cap tech stocks technically vastly disconnected.

I’m not saying any of these companies mentioned are bad, or are doing badly. I’m not saying this at all. Nor am I saying a top is in. But what I am saying is that they are technically stretched, the index and many of these stocks are completely uncorrected and to a large degree probably over-owned. In short, they have been in beast mode and risk/reward is setting up for a sizable corrective move. Even a beast needs some rest at some point.

What happens after the first real $VIX spike, when we get it, will then determine whether this market can make new highs or not. If it can’t then we may embark on what I described the coming bear market.

Given how moderately many asset classes have performed since the highs almost 2 years ago in May of 2015 a rebalancing of pricing may pose a challenge for a wide array of narratives:

Banks and tech, for example, have done very well. Other sectors or indices are either kinda flat or very much challenged.

So far $SPX has made an all-time high at the beginning of March. Yesterday $NDX made a new high almost a month later. The last time we saw an $SPX peak followed by an $NDX peak almost a month later? 2007.

My take fwiw: Bulls need a new $SPX high in April or the beast may turn on them.