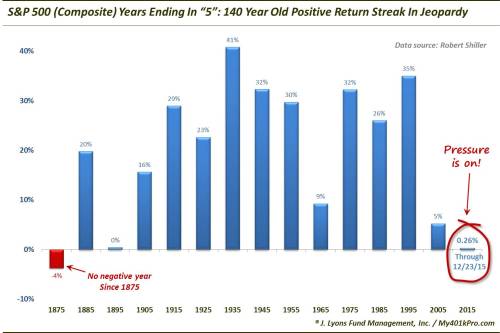

The last trading week of 2015 begins on a historic precipice for stocks: as reported over the weekend, the U.S. stock market has not been lower for any year ending in a “5? since 1875.

That streak however is now in jeopardy, because following Thursday's shortened holiday session which abruptly ended with a mini selloff in the last minutes of trading, the overnight session has seen continued weakness across global assets in everything from Chinese stocks which tumbled the most since November 27 (SHCOMP wipes out down 2.6% as China B Shares plunge 7.9% while USD/CNY climbs 0.16% to 6.4868 after earlier touching 6.4880, matching four year highs) to commodities - after its tremendous surge over the past week, WTI is back down 2.5% and sliding on Gartman's ringing endorsement - including copper and precious metals, to European stocks (Stoxx 600 -0.4%), to US equity futures down 0.3% on what appears to be an overdue dose of Santa Rally buyers' remorse.

Here is where we stand currently:

- S&P 500 futures down 0.4% to 2044

- Stoxx 600 down 0.4% to 365

- FTSE 100 closed

- DAX down 0.2% to 10711

- German 10Yr yield down 3bps to 0.61%

- Italian 10Yr yield down 5bps to 1.63%

- MSCI Asia Pacific down less than 0.1% to 131

- Nikkei 225 up 0.6% to 18873

- Hang Seng down 1% to 21920

- Shanghai Composite down 2.6% to 3534

- S&P/ASX 200 closed

- US 10-yr yield up less than 1bp to 2.24%

- Dollar Index up 0.05% to 97.9

- WTI Crude futures down 2.5% to $37.11

- Brent Futures down 2% to $37.13

- Gold spot down 0.4% to $1,072

- Silver spot down 2.2% to $14.06

A closer look at Asian markets shows that shares fall with Chinese stocks declining most with the Shanghai Composite Index’s worst day in a month as fresh signs of slowing growth in China added to concern looming changes to the country’s listing regime and the expiration of a share-sale ban will hurt demand for its stocks. Investors are fretting that the end of a six-month ban on sales by shareholders with stakes of 5 percent or more in Chinese companies will unleash another wave of selling just as reforms to the initial public offering system see a raft of new listings dilute demand for existing equities.

Compounding those concerns, the head of the nation’s third-largest mobile carrier was swept up in anti-graft crackdown. China Telecom Corp., the nation’s third-largest wireless carrier, dropped 1.3 percent in Hong Kong. China’s Central Commission for Discipline Inspection said in a statement on Sunday that Chang Xiaobing, who headed China Unicom (Hong Kong) Ltd. for more than a decade before becoming chairman and chief executive officer of China Telecom in September, is being probed for severe disciplinary violations.

Japanese stocks outperform; Australian mkt closed for Boxing Day holiday. "Investors don’t like declining industrial profits and they don’t like ongoing corruption investigations in China," said Andrew Clarke, director of trading at Mirabaud Asia. "There are plenty of reasons to lighten their load ahead of the new year and there’s no reason to open any new positions. That’s going to exaggerate the down swing in the market." 7 out of 10 sectors fall with health care, materials outperforming; energy, utilities underperform. Of note, China Nov. Industrial Companies’ Profit Falls 1.4% Y/y while China's November Railway Cargo Shipments plunged 15.6% Y/y to 270m Tons, confirming the severity of China's slowdown.

Top Asian News

- China’s Stocks Fall Most in Month on Industrial Profits, IPOs: Profits of industrial cos. declined; concern grew that new system for IPOs will damp demand for existing equities.

- Japan Industrial Output Drops for First Time in Three Months: Nov. industrial production falls 1% m/m vs est. -0.5%

- China Fines Eight Shipping Lines $63 Million for Price Collusion: Nippon Yusen, Mitsui OSK, Kawasaki Kisen among those indicted

- Rupee in Longest Winning Run Since 2011 as Inflows Seen Resuming: 10-yr sovereign bonds rise for 3rd straight day

- Top Asia Junk Bond Funds All Bought China Builders After Default: Allianz, Value Partners, Aviva all see higher default rates

- China Broadens Campaign Against Terrorism With Sweeping New Law: First anti-terror law lets PLA take part in operations abroad

- Taiwan President Frontrunner Disputes China Framework for Talks: Tsai says “1992 consensus” only one option for stable ties

- Won Gains; Japan Industrial Output Misses Estimate

- Macau Nov. Visitor Arrivals Fall 7.6% Y/y

In Europe, French, Portuguese, Dutch bourses lead declines, while U.K. mkt closed for Boxing Day holiday. In a failed attempt to stir bullish spirits, the ECB's Yves Mersch did what ECB executive board members do every several days and attempted to jawbone the EUR lower and stocks higher: "We can add-on any time, should this be necessary. We still have ammunition and firepower,” he said in a pre-release of IBF interview. Speaking on deposit rate, says “theoretically, the current minus 0.3 percent doesn’t have to be the lower bound."

Alas, as of this moment all 19 Stoxx 600 sectors fall with oil & gas, basic resources leading underperformance among sectors; health care, tech outperforming. Energy companies led declines in the Stoxx Europe 600 Index as crude fell from a three-week high A gauge of oil and gas producers in Europe sank 0.8 percent as all but one industry group declined.

The volume of shares changing hands on the Stoxx 600 was almost 70 percent below the 30-day average. As Bloomberg notes, the index is heading for its worst December since 2002 after an addition in European Central Bank stimulus fell short of investor expectations, while energy and commodity producers deepened their losses.

Top European News:

- EQT Partners Prepares to Sell Parking Co. Parkia: Expansion: Sweden’s EQT taking first steps towards sale of Parkia, Spain’s third-biggest car-parking co.

- Monte Paschi Agrees to Sell NPLs to Epicuro SPV: Bank to sell NPLs with book value ~EU1b to Epicuro SPV, a co. financed by affiliates of Deutsche Bank.

- Oi to Seek Financial Adviser for Tim Deal, More Financing: Valor: Oi board in early 2016 will approve hiring of financial institution to work with BTG Pactual to advise on deal with Telecom Italia, Russian fund LetterOne.

- Knightsbridge Home Prices Drop Most in Central London on Tax: Area is worst performing housing market in central London this year as rising taxes curb valuations in that district.

FX

In global currencies, the Bloomberg Dollar Spot Index added 0.1 percent after weakening for five straight days through Thursday. Commodity-producers’ currencies weakened as oil resumed its decline. The Canadian dollar and Mexico’s peso both retreated 0.4 percent. The ruble sank 2.4 percent, the most since Oct. 27 and just hit fresh all time lows on renewed concerns about a slowdown in the Russian economy.

An index of 20 emerging-market currencies dropped 0.2 percent after rising 0.6 percent last week in the biggest gain since November. The gauge has lost 14 percent in 2015 as all but one of the 24 developing-nation exchange rates tracked by Bloomberg weakened, led by the Argentine peso, Brazilian real, Colombian peso and South Africa’s rand.

The MSCI Emerging Markets Index fell on Monday after rising almost 4 percent in the past two weeks. Equities in Poland, Russia, South Africa fell at least 0.4 percent. Stocks in Dubai declined 1.3 percent.

Commodities

Brent crude fell 2.1 percent to $37.11 a barrel. Iran plans to add 500,000 barrels a day of exports one week after sanctions are lifted, said Rokneddin Javadi, deputy oil minister and head of National Iranian Oil Co., according to Shana news agency.

U.S. natural gas futures advanced 2.9 percent, heading for a third straight increase. The contract has gained more than 10 percent in three days amid forecasts for an end to unseasonably warm conditions that had curbed demand for heating fuel.

Gold for immediate delivery declined 0.4 percent. Copper slumped 2.2 percent in New York after the industrial profits report for China highlighted concern that demand for the metal may weaken in the world’s largest user. The London Metal Exchange was closed for a U.K. public holiday.

Global Top Stories:

- Pep Boys Agrees to $947 Million Bridgestone Bid, Shuns Icahn: Bridgestone’s new offer is $17/share, exceeding Icahn’s most recent bid of $16.50/share; still below maximum $18.10/share that Icahn said he is willing to pay.

- ‘Star Wars: The Force Awakens’ Crosses $1 Billion in Sales: Film reached $1b in worldwide sales in 12 days, becoming first picture to reach that mark so quickly.

- Amazon Reports Record-Setting Holiday for Prime, Original Series: >3m members worldwide joined Amazon Prime during third week of Dec.

- Rentrak: Christmas Wknd Total Gross at Least $300m for 2nd Straight Wk

- FedEx Draws Consumer Scorn as Grinch Over Late Shipments: Co. said in e-mailed statement it was running an expanded operation, delivering “remaining delayed shipments along with our normal Saturday volume”; packages bound for residences were getting priority, co. said.

- Incyte Wants to Remain Independent, CEO Hoppenot Tells Le Temps: Every decision is made “in the context of our desire to remain independent,” CEO Herve Hoppenot is cited in interview.

- Valeant CEO Pearson Still Hospitalized After Pneumonia Care: Pearson discharged from a New Jersey hospital after treatment for “severe” pneumonia, though is still hospitalized.

- China Passes Counter-Terrorism Law That Sparked U.S. Concern: Law has drawn U.S. criticism for assistance that foreign tech cos. may be required to give to Chinese authorities.

- Zuckerberg Makes Personal Appeal for Free Internet in India: Facebook CEO promoted his co.’s Free Basics plan in one of India’s leading newspapers.

- Amazon Plans to Produce 16 Films, Win Oscar, WamS Cites Bezos: “Our current target is to produce 16 of our own films per year,” Amazon CEO Jeff Bezos tells Welt am Sonntag in interview.

- GE Wins Part of $15.5b China Hydropower Plant Contract: Co. wins contract to supply turbines that account for half of 10.2GW generation capacity at Wudongde hydropower plant being built by China Three Gorges Corp.

Bulletin Headline Summary From BBG:

- Treasuries decline led by short end before before year’s last auctions begin with $26b 2Y notes; WI yield 1.06%, highest since August 2009.

- China’s stocks fell the most in a month as industrial company profits declined and concern grew a new system for initial public offerings will damp demand for existing equities

- China’s banking regulator laid out planned restrictions on thousands of online peer-to-peer lenders, pledging to “cleanse the market” as failed platforms and suspected frauds highlight risks within a booming industry

- Saudi Arabia, seeking to cope with the lowest oil prices in more than a decade, may announce cuts in capital spending and other economic measures for next year as it unveils the first annual budget under King Salman

- For an industry that already was pushing its cost- cutting efforts to the limits, the oil price declines to the $35/bbl level are a devastating blow as fracking firms are “not set up to survive oil in the $30s,” said R.T. Dukes, a senior upstream analyst for Wood Mackenzie Ltd. in Houston

- Japan’s industrial output fell for the first time in three months in November, as exports fell more than expected and households spent less

- Iraqi forces have recaptured the main government complex in Ramadi held by Islamic State since May, a day after the extremist group’s leader said in a rare audio address that recent setbacks hadn’t weakened the militants

- The U.K. is moving to fix a barrier on the Foss river in York as unprecedented rainfall has forced thousands of residents to evacuate because of rising flood waters

- $1.5t IG priced in 2015, $247b HY. BofAML Corporate Master Index OAS +174, YTD range 180/129. High Yield Master II OAS +705; YTD range 733/438

- Sovereign 10Y bond yields mostly lower. Asian stocks mostly lower led by China, European stocks fall, U.S. equity-index futures drop. Crude oil, gold and copper fall

US Event Calendar

- 10:30am: Dallas Fed Manf. Activity, Dec., est. -6 (prior -4.9)

- 1:00pm: U.S. sells $26b 2Y notes