Written By Niccolo Conte

Graphics & Design

- Pernia Jamshed

Published November 25, 2022

•

Updated November 25, 2022

•

TweetShareShareRedditEmail

The following content is sponsored by Gold Royalty

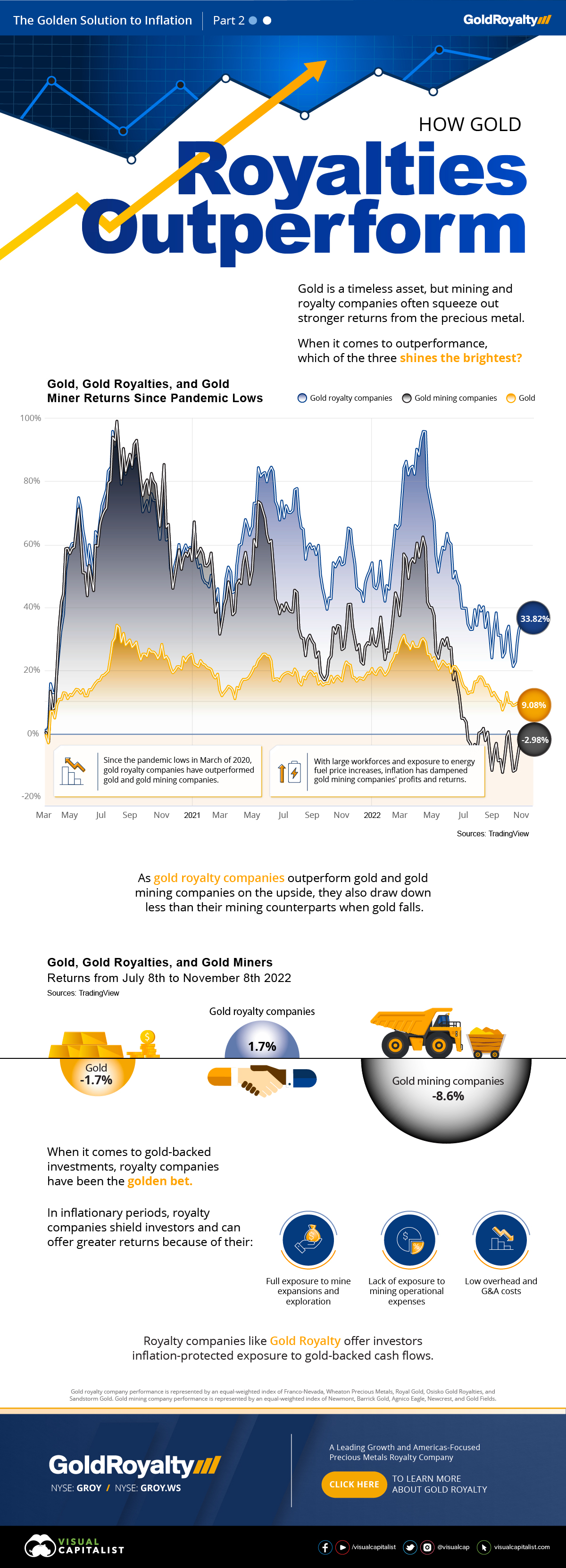

How Gold Royalties Outperform Gold and Mining Stocks

Gold and gold mining companies have long provided a diverse option for investors looking for gold-backed returns, however royalty companies have quietly been outperforming both.

While inflation’s recent surge has dampened profits for gold mining companies, royalty companies have remained immune thanks to their unique structure, offering stronger returns in both the short and long term.

After Part One of this series sponsored by Gold Royalty explained exactly how gold royalties avoid rising expenses caused by inflation, Part Two showcases the resulting stronger returns royalty companies can offer.

Comparing Returns

Since the pandemic lows in mid-March of 2020, gold royalty companies have greatly outperformed both gold and gold mining companies, shining especially bright in the past year’s highly inflationary environment.

While gold is up by 9% since the lows, gold mining companies are down by almost 3% over the same time period. On the other hand, gold royalty companies have offered an impressive 33% return for investors.

In the graphic above, you can see how gold royalty and gold mining company returns were closely matched during 2020, but when inflation rose in 2021, royalty companies held strong while mining company returns fell downwards.

| Returns since the pandemic lows (Mid-March 2020) |

Returns of the past four months (July 8-November 8, 2022) |

|

|---|---|---|

| Gold Royalty Companies | 33.8% | 1.7% |

| Gold | 9.1% | -1.7% |

| Gold Mining Companies | -3.0% | -8.6% |

Even over the last four months as gold’s price fell by 1.7%, royalty companies managed to squeeze out a positive 1.7% return while gold mining companies dropped by 8.6%.

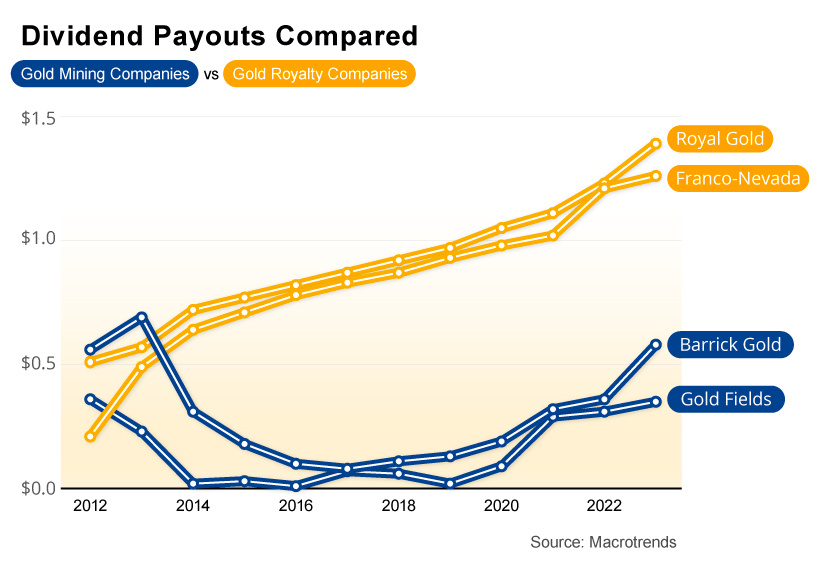

Gold Royalty Dividends Compared to Gold Mining Companies

Along with more resilient returns, gold royalty companies also offer significantly more stability than gold mining companies when it comes to dividend payouts.

Gold mining companies have highly volatile dividend payouts that are significantly adjusted depending on gold’s price. While this has provided high dividend payouts when gold’s price increases, it also results in huge dividend cuts when gold’s price falls as seen in the chart below.

Rather than following gold’s price, royalty companies seek to provide growing stability with their dividend payouts, adjusting them so that shareholders are consistently rewarded.

Over the last 10 years, dividend-paying royalty companies have steadily increased their payouts, offering stability even when gold prices fall.

Why Gold Royalty Companies Outperform During Inflation

Gold has provided investors with the stability of a hard monetary asset for centuries, with mining companies offering a riskier high volatility bet on gold-backed cash flows. However, when gold prices fall or inflation increases operational costs, gold mining companies fall significantly more than the precious metal.

Gold royalty companies manage to avoid inflation’s bite or falling gold prices’ crunch on profit margins as they have no exposure to rising operational expenses like wages and energy fuels while also having a much smaller headcount and lower G&A expenses as a result.

Along with avoiding rising expenses, gold royalty companies still retain exposure to mine expansions and exploration, offering just as much upside as mining companies when projects grow.

Gold Royalty offers inflation-resistant gold exposure with a portfolio of royalties on top-tier mines across the Americas. Click here to find out more about Gold Royalty.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #precious metals #inflation #stocks #dividends #Gold mining Companies #Gold Royalty Companies

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "How Gold Royalties Outperform Gold and Mining Stocks";

var disqus_url = "https://www.visualcapitalist.com/sp/how-gold-royalties-outperform-gold-and-mining-stocks/";

var disqus_identifier = "visualcapitalist.disqus.com-153775";

You may also like

-

Markets1 day ago

Ranked: The World’s 100 Biggest Pension Funds

The world’s 100 largest pension funds are worth over $17 trillion in total. Which ones are the biggest, and where are they located?

-

Agriculture2 days ago

Ranked: The World’s Top Cotton Producers

As the most-used natural fiber, cotton has become the most important non-food agricultural product.

-

Energy2 days ago

Visualizing the World’s Largest Hydroelectric Dams

Hydroelectric dams generate 40% of the world’s renewable energy, the largest of any type. View this infographic to learn more.

-

Misc3 days ago

Countries with the Highest (and Lowest) Proportion of Immigrants

Here, we highlight countries that are magnets for immigration, such as UAE and Qatar, as well as nations with very few foreign born residents.

-

Datastream4 days ago

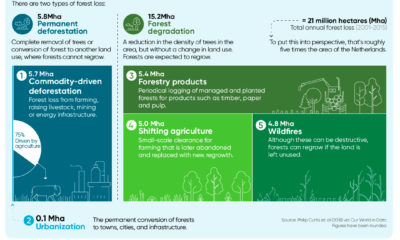

Visualizing the Five Drivers of Forest Loss

Approximately 15 billion trees are cut down annually across the world. Here’s a look at the five major drivers of forest loss. (Sponsored)

-

Personal Finance4 days ago

Ranked: The Best Countries to Retire In

Which countries are the best equipped to support their aging population? This graphic show the best countries to retire in around the world.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 350,000+ subscribers who receive our daily email *Sign Up

The post How Gold Royalties Outperform Gold and Mining Stocks appeared first on Visual Capitalist.