![]()

See more visuals like this on the Voronoi app.

Use This Visualization

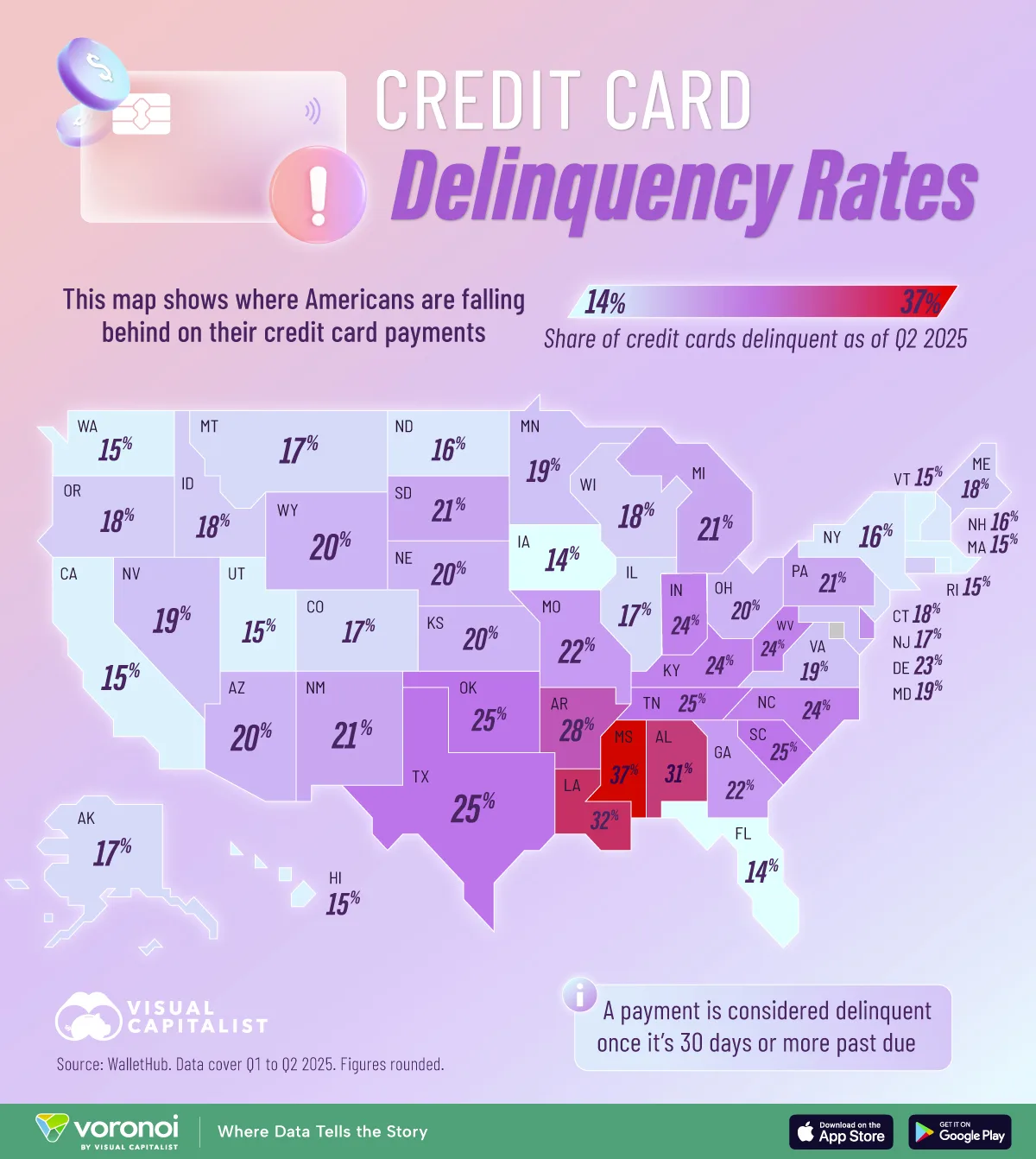

Mapped: U.S. Credit Card Delinquency Rates by State (2025)

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- A payment is considered delinquent once it’s 30 days or more past due. Lenders report these late payments to credit bureaus, which can lower credit scores and signal financial stress in the economy.

- Credit card delinquency rates are highest in the Deep South, led by Mississippi (37%), Louisiana (32%), and Alabama (31%).

The map above highlights how credit card delinquency varies widely across the U.S. in 2025.

These figures represent the share of credit card accounts that became 30 or more days past due from Q1 to Q2. The data for this visualization comes from WalletHub.

Southern States Lead in Delinquencies

The Deep South stands out with the nation’s highest delinquency rates. Mississippi tops the list at 37%, followed by Louisiana at 32% and Alabama at 31%.

These levels are far above the national norm and suggest elevated financial pressures, including lower median incomes and higher reliance on revolving debt. Several neighboring states—Arkansas, Oklahoma, Tennessee, and South Carolina—also exceed 25%.

| Rank | State | Credit Card Delinquency (Q1-Q2, 2025) |

|---|---|---|

| 1 | Mississippi | 36.69% |

| 2 | Louisiana | 32.11% |

| 3 | Alabama | 30.52% |

| 4 | Arkansas | 28.11% |

| 5 | South Carolina | 25.49% |

| 6 | Oklahoma | 25.43% |

| 7 | Texas | 24.77% |

| 8 | Tennessee | 24.62% |

| 9 | North Carolina | 24.19% |

| 10 | Kentucky | 24.07% |

| 11 | Indiana | 23.92% |

| 12 | West Virginia | 23.71% |

| 13 | Delaware | 22.76% |

| 14 | Georgia | 22.40% |

| 15 | Missouri | 22.26% |

| 16 | New Mexico | 21.37% |

| 17 | Pennsylvania | 21.08% |

| 18 | Michigan | 20.89% |

| 19 | South Dakota | 20.64% |

| 20 | Wyoming | 20.23% |

| 21 | Kansas | 19.76% |

| 22 | Arizona | 19.72% |

| 23 | Nebraska | 19.71% |

| 24 | Ohio | 19.66% |

| 25 | Maryland | 19.45% |

| 26 | Minnesota | 19.17% |

| 27 | Virginia | 19.09% |

| 28 | Nevada | 18.58% |

| 29 | Idaho | 18.42% |

| 30 | Wisconsin | 18.35% |

| 31 | Maine | 18.27% |

| 32 | Connecticut | 18.16% |

| 33 | Oregon | 17.87% |

| 34 | Montana | 17.17% |

| 35 | Alaska | 16.90% |

| 36 | Colorado | 16.85% |

| 37 | Illinois | 16.58% |

| 38 | New Jersey | 16.57% |

| 39 | North Dakota | 16.26% |

| 40 | New Hampshire | 15.59% |

| 41 | New York | 15.53% |

| 42 | Rhode Island | 15.21% |

| 43 | California | 15.08% |

| 44 | Washington | 14.99% |

| 45 | Utah | 14.94% |

| 46 | Hawaii | 14.90% |

| 47 | Massachusetts | 14.68% |

| 48 | Vermont | 14.67% |

| 49 | Iowa | 14.36% |

| 50 | Florida | 13.99% |

Midwestern and Northeastern States Remain More Stable

Most states across the Midwest and Northeast report delinquency shares between 15% and 21%. These levels reflect more stable household budgets and stronger credit profiles.

States like Iowa (14%) and Minnesota (19%) show some of the lowest delinquency rates, pointing to higher financial resilience.

Western States Show Mixed Patterns

The Western U.S. presents a more mixed landscape. California, Washington, Utah, and Hawaii all sit near the lower end at around 15%, suggesting relatively healthy consumer finances despite high living costs.

Meanwhile, states like Arizona and Nevada land closer to 19–20% in late payments.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out The United States of Unemployment on Voronoi, the new app from Visual Capitalist.