![]()

Published

2 hours ago

on

January 26, 2026

| 3,800 views

-->

By

Julia Wendling

Graphics & Design

- Athul Alexander

- Sabrina Lam

See this visualization first on the Voronoi app.

Ranked: Top 10 ETF Themes That Crushed the S&P 500 in 2025

Rising geopolitical strain defined financial markets in 2025. Capital moved toward assets linked to security, energy, and strategic control. Investors favored themes that reflected real world power dynamics rather than broad market averages.

This analysis uses data from ETF Central, our data partner for this post. Their figures show how sharply thematic returns diverged from the broader market. The S&P 500 rose 17.9%, a solid gain in isolation. Yet it trailed far behind sectors aligned with global instability and state driven investment priorities.

Security and Strategic ETF Assets Took the Lead

Strategic metals delivered the strongest performance of any ETF theme. Returns reached 94.9% as nations rushed to secure materials critical for defense systems, batteries, and advanced manufacturing. Supply chain control became a top economic priority.

| Rank | Investment Theme | 2025 Return |

|---|---|---|

| 1 | Strategic Metals | 94.9% |

| 2 | Europe Defense | 75.1% |

| 3 | Global Defense | 70.9% |

| 4 | Life Sciences | 66.3% |

| 5 | Battery Value-Chain | 64.1% |

| 6 | Nuclear Energy | 61.7% |

| 7 | Space & Deep Sea | 53.5% |

| 8 | Solar Energy | 51.2% |

| 9 | Alternative Energy | 47.1% |

| 10 | U.S. Defense | 46.7% |

| S&P 500 | 17.9% |

Defense followed closely behind. Europe defense returned 75.1%, while global defense gained 70.9%. U.S. defense also performed well with a 46.7% return.

Higher military budgets and prolonged conflicts sustained long term demand. Life sciences added to the momentum, rising 66.3% as innovation continued despite market uncertainty.

Energy Transition Outperformed the Benchmark

Energy related themes dominated the middle of the rankings. The battery value chain returned 64.1% as electric vehicles and grid storage expanded worldwide. Nuclear energy gained 61.7% as governments reconsidered reliable baseload power.

Solar energy posted a 51.2% return, while alternative energy rose 47.1%. Energy security became just as important as emissions reduction. Investors rewarded technologies that offered resilience and scale. In 2025, focused exposure captured the defining trends that broad indexes could not.

Learn More on the Voronoi App ![]()

To learn more about this topic, check out this graphic on investment peaks by industry.

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Ranked: Top 10 ETF Themes That Crushed the S&P 500 in 2025";

var disqus_url = "https://www.visualcapitalist.com/dp/ranked-top-10-etf-themes-that-crushed-the-sp-500-in-2025/";

var disqus_identifier = "visualcapitalist.disqus.com-194545";

You may also like

-

Markets5 days ago

Charted: The Battle for AI Data Center Revenue (2021–2025)

With the generative AI boom igniting demand for AI chips and data centers, how has market share changed between NVIDIA, AMD, and Intel?

-

Markets1 week ago

How Nvidia’s Market Cap Stacks Up Against Entire Countries

Nvidia’s valuation now rivals entire G7 economies. See how the tech company’s market cap compares to the largest country economies.

-

Markets2 weeks ago

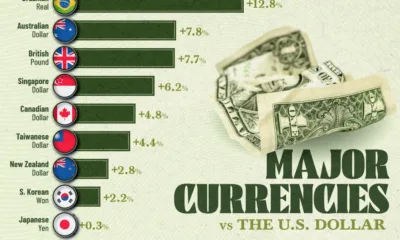

Charted: The Rise of Major Currencies Against the U.S. Dollar in 2025

As the U.S. dollar weakened in 2025, we show the appreciation of several currencies against the U.S. dollar in a highly unpredictable year.

-

Investor Education2 weeks ago

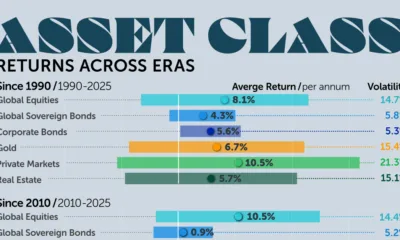

Charted: Asset Class Returns Across Eras (1990–2025)

Private markets show the highest long-term returns, while gold has been the best-performing asset since 2020.

-

Stocks3 weeks ago

Charted: Winners and Losers in U.S. Stocks Over the Last Year

We round up the winners and losers in the U.S. stock market over the last 12 months, focusing in on sector and company performance.

-

Markets4 weeks ago

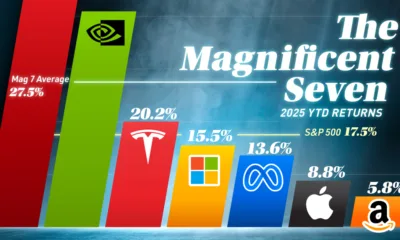

Ranked: Magnificent Seven Stock Returns in 2025

As AI competition intensifies, performance across the Magnificent Seven stocks has sharply diverged in 2025.

Subscribe

Please enable JavaScript in your browser to complete this form.Join 375,000+ email subscribers: *Sign Up