![]()

See this visualization first on the Voronoi app.

Use This Visualization

Charted: S&P 500 vs S&P 500 Equal Weight Index

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

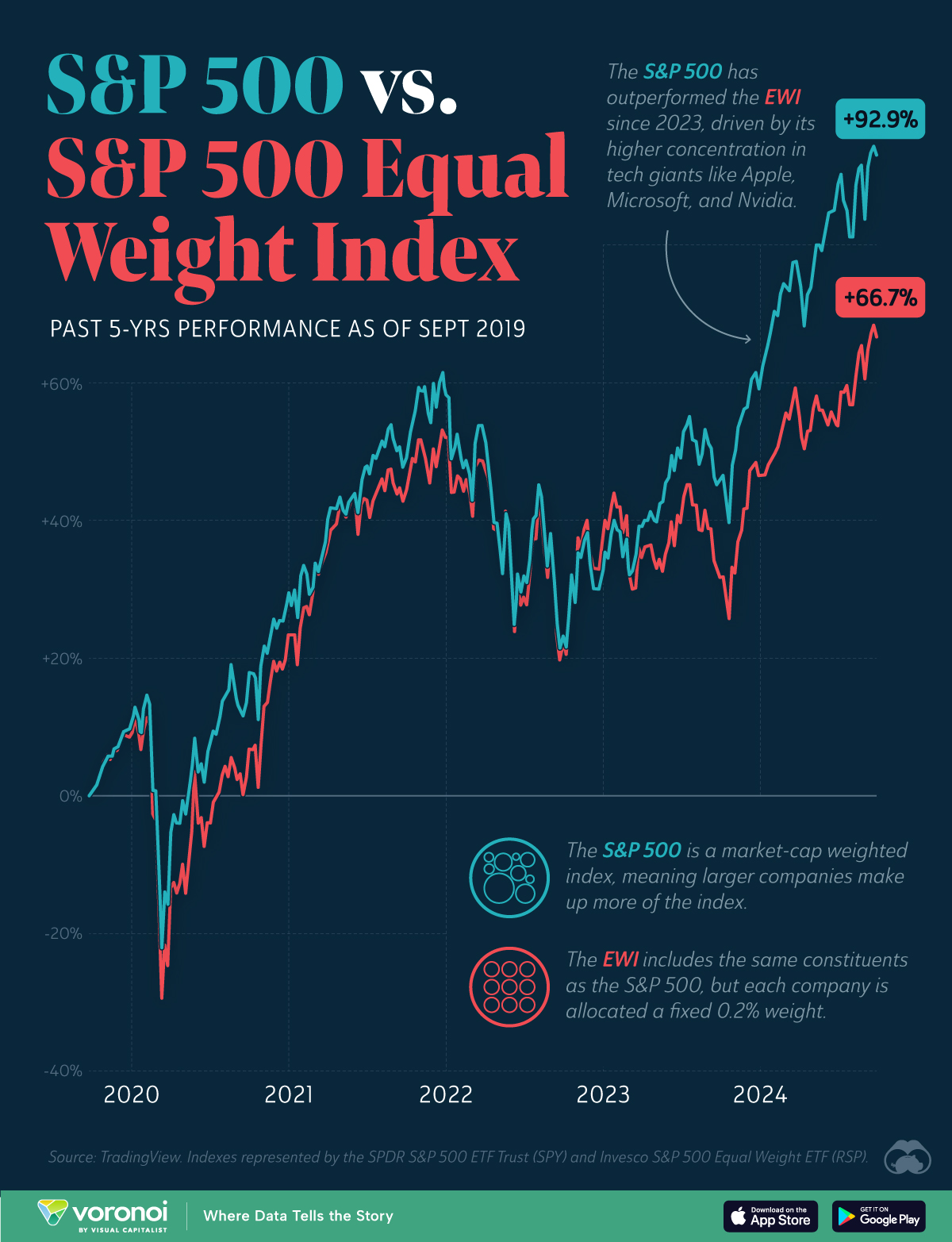

In this graphic, we compare the performance of the S&P 500 and the S&P 500 Equal Weight Index (EWI) since Sept. 2019.

The regular S&P 500 is a market-cap weighted index, which means that its constituents are weighted by their market capitalization. As a result, larger companies like Apple, Nvidia, and Microsoft make up a bigger portion of the index.

The S&P 500 EWI includes the same constituents but allocates each company a fixed 0.2% weight.

Data and Key Takeaways

The performance data shown in this graphic is based on the SPDR S&P 500 ETF Trust (Ticker: SPY) and the Invesco S&P 500 Equal Weight ETF (Ticker: RSP).

SPY is is the largest ETF tracking the S&P 500 ($585B in AUM), while RSP is the largest ETF tracking the S&P 500 EWI ($64B in AUM). The large difference in AUM between these two leading ETFs is a sign of the EWIs lower popularity.

The following table shows the percentage growth of both indexes over the past several years as of September.

| Date | SPY | RSP |

|---|---|---|

| Sept 2019 | -- | -- |

| Sept 2020 | 13.4% | 2.5% |

| Sept 2021 | 47.5% | 42.8% |

| Sept 2022 | 21.4% | 19.7% |

| Sept 2023 | 45.2% | 33.3% |

| Sept 2024 | 92.9% | 66.7% |

Looking past 2020 as an outlier year due to COVID-19, the S&P 500 EWI mostly kept up with the S&P 500—until 2023.

Since then, the Magnificent 7 tech stocks have greatly outperformed the market, benefiting the market-cap weighted S&P 500 because of its higher concentration in these large companies.

For context, Nvidia alone was responsible for 20% of the S&P 500’s gains over the first three quarters of 2024.

The S&P 500 EWI, on the other hand, has missed out on these gains because the primary growth drivers (e.g. Nvidia) only make up 0.2% of the index.

Why Follow the EWI?

An investor might choose to invest in an S&P 500 EWI product if they were concerned about diversification. In a scenario where large-cap companies like Apple underperformed, the EWI could potentially mitigate this risk.

Learn More on the Voronoi App ![]()

If you enjoyed this post, check out this graphic that compares the Magnificent 7 to seven of the top stocks from the 2000s Tech Bubble.

The post Charted: S&P 500 vs. S&P 500 Equal Weight Index appeared first on Visual Capitalist.