![]()

See this visualization first on the Voronoi app.

Use This Visualization

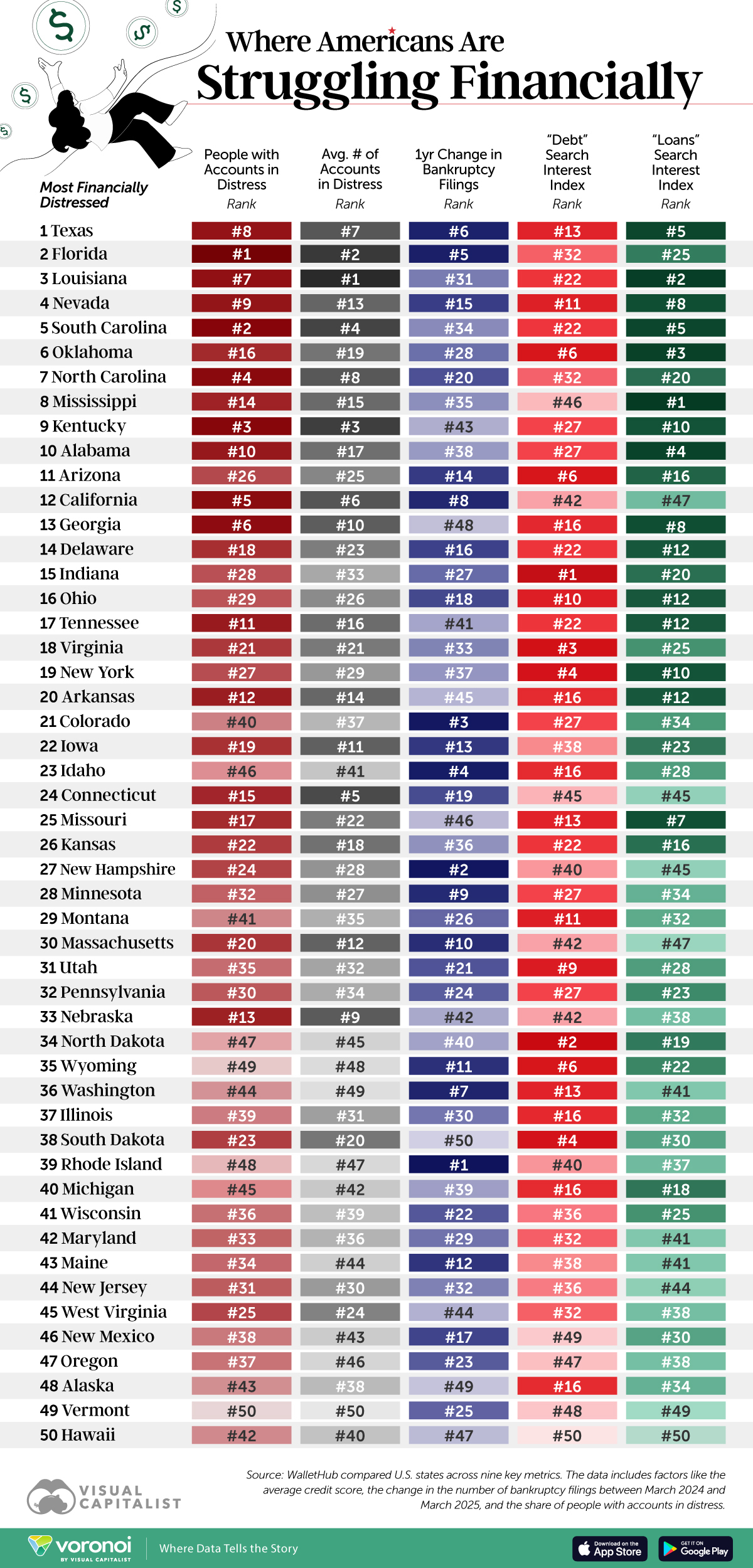

Ranked: Where Americans Are Struggling the Most Financially

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Southern states dominate the list of places where Americans are in the most financial distress.

- Texas, Florida, and Louisiana rank highest due to high distress rates and rising bankruptcy filings.

Americans across the country are facing increasing financial pressure. This visualization ranks all 50 U.S. states by a composite score of financial distress indicators. The data includes number of accounts in distress, bankruptcy trends, and even online search behavior for debt-related terms between March 2024 and March 2025.

The data for this visualization comes from WalletHub.

The South Leads in Financial Struggles

Texas tops the list as the most financially distressed state, followed by Florida, Louisiana, Nevada, and South Carolina. These states consistently rank poorly across multiple indicators, particularly in the number and average count of distressed accounts.

| Rank | State | People with Accounts in Distress | Avg # of Accounts in Distress | Change in Bankruptcy Filings (2025 vs. 2024) | “Debt” Search Interest Index | “Loans” Search Interest Index |

|---|---|---|---|---|---|---|

| 1 | Texas | 8 | 7 | 6 | 13 | 5 |

| 2 | Florida | 1 | 2 | 5 | 32 | 25 |

| 3 | Louisiana | 7 | 1 | 31 | 22 | 2 |

| 4 | Nevada | 9 | 13 | 15 | 11 | 8 |

| 5 | S. Carolina | 2 | 4 | 34 | 22 | 5 |

| 6 | Oklahoma | 16 | 19 | 28 | 6 | 3 |

| 7 | N. Carolina | 4 | 8 | 20 | 32 | 20 |

| 8 | Mississippi | 14 | 15 | 35 | 46 | 1 |

| 9 | Kentucky | 3 | 3 | 43 | 27 | 10 |

| 10 | Alabama | 10 | 17 | 38 | 27 | 4 |

| 11 | Arizona | 26 | 25 | 14 | 6 | 16 |

| 12 | California | 5 | 6 | 8 | 42 | 47 |

| 13 | Georgia | 6 | 10 | 48 | 16 | 8 |

| 14 | Delaware | 18 | 23 | 16 | 22 | 12 |

| 15 | Indiana | 28 | 33 | 27 | 1 | 20 |

| 16 | Ohio | 29 | 26 | 18 | 10 | 12 |

| 17 | Tennessee | 11 | 16 | 41 | 22 | 12 |

| 18 | Virginia | 21 | 21 | 33 | 3 | 25 |

| 19 | New York | 27 | 29 | 37 | 4 | 10 |

| 20 | Arkansas | 12 | 14 | 45 | 16 | 12 |

| 21 | Colorado | 40 | 37 | 3 | 27 | 34 |

| 22 | Iowa | 19 | 11 | 13 | 38 | 23 |

| 23 | Idaho | 46 | 41 | 4 | 16 | 28 |

| 24 | Connecticut | 15 | 5 | 19 | 45 | 45 |

| 25 | Missouri | 17 | 22 | 46 | 13 | 7 |

| 26 | Kansas | 22 | 18 | 36 | 22 | 16 |

| 27 | N. Hampshire | 24 | 28 | 2 | 40 | 45 |

| 28 | Minnesota | 32 | 27 | 9 | 27 | 34 |

| 29 | Montana | 41 | 35 | 26 | 11 | 32 |

| 30 | Massachusetts | 20 | 12 | 10 | 42 | 47 |

| 31 | Utah | 35 | 32 | 21 | 9 | 28 |

| 32 | Pennsylvania | 30 | 34 | 24 | 27 | 23 |

| 33 | Nebraska | 13 | 9 | 42 | 42 | 38 |

| 34 | North Dakota | 47 | 45 | 40 | 2 | 19 |

| 35 | Wyoming | 49 | 48 | 11 | 6 | 22 |

| 36 | Washington | 44 | 49 | 7 | 13 | 41 |

| 37 | Illinois | 39 | 31 | 30 | 16 | 32 |

| 38 | S. Dakota | 23 | 20 | 50 | 4 | 30 |

| 39 | Rhode Island | 48 | 47 | 1 | 40 | 37 |

| 40 | Michigan | 45 | 42 | 39 | 16 | 18 |

| 41 | Wisconsin | 36 | 39 | 22 | 36 | 25 |

| 42 | Maryland | 33 | 36 | 29 | 32 | 41 |

| 43 | Maine | 34 | 44 | 12 | 38 | 41 |

| 44 | New Jersey | 31 | 30 | 32 | 36 | 44 |

| 45 | West Virginia | 25 | 24 | 44 | 32 | 38 |

| 46 | New Mexico | 38 | 43 | 17 | 49 | 30 |

| 47 | Oregon | 37 | 46 | 23 | 47 | 38 |

| 48 | Alaska | 43 | 38 | 49 | 16 | 34 |

| 49 | Vermont | 50 | 50 | 25 | 48 | 49 |

| 50 | Hawaii | 42 | 40 | 47 | 50 | 50 |

Texas, for example, ranks 8th for the number of people in distress and 7th for the average number of distressed accounts. Louisiana ranks 1st in average accounts in distress.

Western and Northeastern States Fare Better

In contrast, many northern and western states rank near the bottom of the distress scale. Hawaii, Vermont, Alaska, and Oregon round out the bottom five, indicating less financial stress overall.

These states tend to show lower bankruptcy increases, fewer accounts in distress, and less debt-related search interest. Notably, Vermont ranks last in the number of people and accounts in distress.

Averaging a distress rank of 32.95, Republican-leaning states are experiencing significantly more financial hardship than Democrat-leaning states, which average a much lower rank of 20.94.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out Mapped: The Income Needed to Join the Top 1% in Every U.S. State on Voronoi, the new app from Visual Capitalist.