![]()

See this visualization first on the Voronoi app.

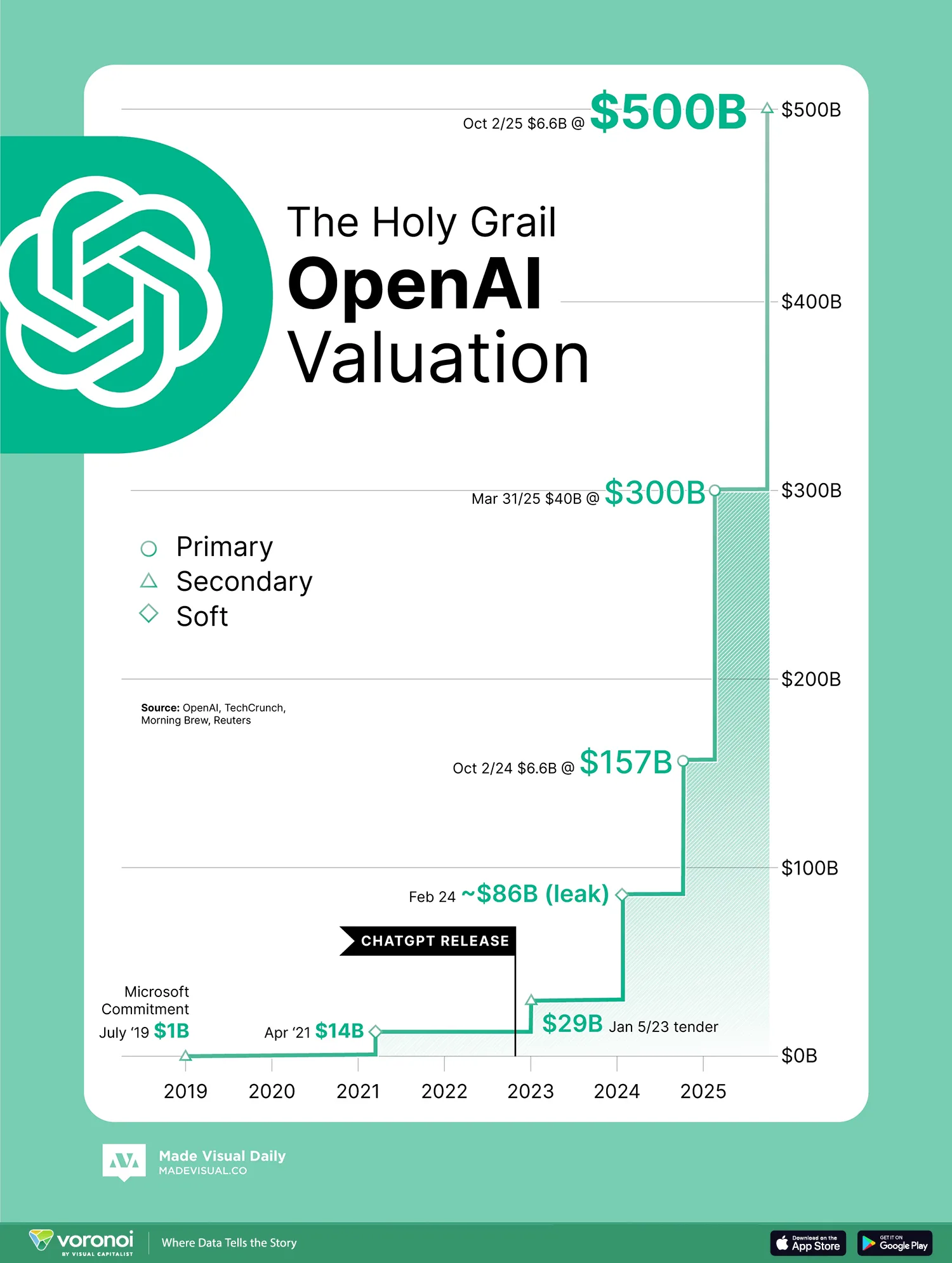

Charted: The Journey to OpenAI’s Staggering $500B Valuation

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

- OpenAI has hit a jaw-dropping $500B valuation after a major secondary share sale.

- The ChatGPT-maker’s valuation has skyrocketed since Microsoft’s initial $1B investment in 2019.

- OpenAI is now the most valuable private company in the world, ahead of SpaceX and ByteDance.

In October 2025, OpenAI became the world’s most valuable private technology company.

A major secondary share sale, enabling insiders to offload $6.6 billion worth of equity, valued the company at $500 billion, according to various media sources. That puts it ahead of SpaceX, Stripe, and ByteDance—and well past the $300 billion valuation assigned just seven months prior.

The chart above, from Made Visual Daily, shows the company’s rapid valuation climb. The data for this valuation timeline was compiled from press reports and funding disclosures:

| Date | Approx. Valuation (USD, billions) | Context |

|---|---|---|

| July 2019 | 1 | Microsoft partnership (cash + Azure credits) |

| April 2021 | 14 | Reported / soft valuation |

| January 2023 | 29 | Secondary tender offer |

| February 2024 | 80–90 | Leak / soft internal valuation |

| October 2024 | 157 | Primary funding round (~$6.6B raise) |

| March 2025 | 300 | Primary funding round (~$40B raise, SoftBank-led) |

| October 2025 | 500 | Secondary share sale (~$6.6B employee shares) |

From Research Lab to AI Superpower

OpenAI started as a nonprofit lab in 2015 with a $1 billion pledge from backers like Elon Musk and Reid Hoffman. In 2019, it restructured into a capped-profit entity and accepted a major investment from Microsoft—signaling a new era of commercialization.

But the true inflection point came in late 2022, when the launch of ChatGPT brought generative AI into public consciousness. Since then, the company’s valuation curve has steepened dramatically:

- In early 2023, it was valued at $29 billion during an employee share sale.

- By March 2025, it was valued at $300 billion after raising a $40 billion funding round led by SoftBank.

- Now, in October 2025, OpenAI’s valuation has reached $500 billion—even without raising new capital.

This latest valuation was not set through a traditional venture round, but through a secondary sale that allowed employees and early investors to cash out. No new money entered the company. Instead, the new valuation reflects how much existing shares are now worth to investors hungry for exposure to AI’s leading player.

What Justifies the $500 Billion Price Tag?

There are a few reasons investors are backing OpenAI at this level.

First, the company’s revenue growth is accelerating. It reportedly generated $4.3 billion in revenue during the first half of 2025, up from an estimated $1.6 billion for all of 2023. Some sources suggest its annual run rate could soon reach $20 billion. With high-margin software products, that kind of revenue scale supports significant valuation multiples.

Second, OpenAI’s products are now deeply embedded across the tech ecosystem. Its language models power Microsoft’s Copilot products, drive usage through ChatGPT, and are licensed via APIs by thousands of companies. That network effect—combined with exclusive partnerships and strong brand recognition—makes its market position unusually defensible.

Third, the company is building out massive infrastructure to support future growth. Through a new joint venture called Stargate LLC, OpenAI is reportedly planning to spend hundreds of billions of dollars on data centers and AI chips. The idea is to reduce reliance on Microsoft and establish a physical and technical moat that few competitors can match.

Finally, the structure of this share sale matters. Because it’s a secondary transaction, OpenAI doesn’t dilute existing shareholders. Instead, insiders are getting liquidity, helping the company retain top AI talent while still appearing financially disciplined.

Looking Ahead

Of course, OpenAI’s rise hasn’t come without questions.

The company faces increasing scrutiny from regulators, as well as growing competition from rivals like Anthropic and Google DeepMind. Its unique corporate structure—a capped-profit model governed by a nonprofit board—has also drawn criticism and confusion.

Still, the momentum is undeniable. A few years ago, OpenAI was a curiosity. Today, it’s a foundational layer in global AI infrastructure. Its $500 billion valuation is a bet—not just on current revenue—but on a future where AI plays a role in nearly every product, process, and business.

Learn More on the Voronoi App

See all of the world’s most valuable private companies in one visualization, including the updated valuation for OpenAI.