Published

12 minutes ago

on

January 28, 2026

| 1,239 views

-->

By

Julia Wendling

Article & Editing

- Ryan Bellefontaine

- Jenna Ross

Graphics & Design

- Jennifer West

The following content is sponsored by New York Life Investments

3 Key Tax Changes for U.S. Investors in 2026

Tax rules rarely sit still, so 2026 could bring meaningful planning ripple effects. As a result, many households may want a fresh look at deductions, transfers, and savings.

This graphic, in partnership with New York Life Investments, shows three key tax-law shifts for U.S. investors using data from the Internal Revenue Service.

1. A New SALT (State & Local Tax) Cap

For households that itemize deductions, the SALT deduction cap jumps from $10,000 to $40,000.

Consequently, in an illustrative example of a married couple filing jointly in the 32% bracket with $40,000 in state and local taxes, federal tax savings rise from $3,200 to $12,800.

Here is a table that shows the old and new SALT caps and the illustrative federal tax savings.

| Deduction | Federal Tax Saved |

|---|---|

| Old SALT cap ($10,000) | $3,200 |

| New SALT cap ($40,000) | $12,800 |

Based on a married couple filing jointly, in the 32% tax bracket, with income below the SALT phase-out and $40,000 in state and local taxes.

However, the benefit can swing widely by state. New York ($7,092) leads the nation, while South Dakota ($1,033) trails, with big coastal states also near the top.

Meanwhile, state tax differences can compound over time for investors.

2. A Rise in the Federal Estate and Gift Tax Exemption

In 2026, the federal lifetime estate and gift tax exemption rises from $13.99M to $15.00M per person. That added headroom can help reduce forced asset sales during wealth transfers.

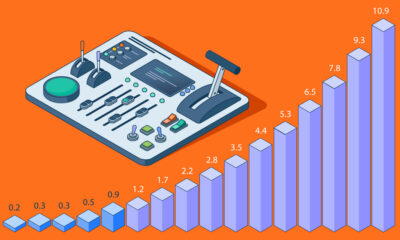

Here is a table showing the result if someone invested the roughly $1M difference at a 10% annual return, which is the average since 1957.

| Year | Total Savings (Millions of U.S. Dollars) |

|---|---|

| 0 | 1.0 |

| 1 | 1.1 |

| 2 | 1.2 |

| 3 | 1.3 |

| 4 | 1.5 |

| 5 | 1.6 |

| 6 | 1.8 |

| 7 | 2.0 |

| 8 | 2.2 |

| 9 | 2.4 |

| 10 | 2.6 |

Average annual return on the S&P 500 since 1957. For illustrative purposes only. Past performance is not a guarantee of future results.

Although results will vary, and markets don’t move in straight lines, it could approach $2.6M after a decade.

3. New Rules for Extra Retirement Contributions After Age 50

The IRS raised the 401(k) elective deferral limit to $24,500 for 2026, up from $23,500 in 2025. At the same time, the age-50 catch-up limit increases from $7,500 to $8,000.

| Year | Base contribution | Catch-up contribution |

|---|---|---|

| 2025 | $23,500.00 | $7,500.00 |

| 2026 | $24,500.00 | $8,000.00 |

Amounts shown are the IRS maximum employee deferral limits for 401(k), 403(b), and governmental 457 plans for individuals age 50 and older. Beginning in 2026, the $8,000 catch-up portion must be made with money that has already been taxed for workers whose prior year wages from that employer exceed the income threshold in the law, approximately $150,000 for 2026 contributions. Under a change made in SECURE 2.0, a higher catch-up contribution limit applies for employees aged 60-63 if their plan allows. The catch-up would be $11,250 (totaling $35,750).

However, the SECURE 2.0 retirement package adds a twist: certain higher earners must make catch-up contributions after-tax as Roth. Because of that, investors may rethink how they balance pre-tax and Roth savings.

What These Key Tax Changes Mean for Investors

Taken together, these Key Tax Changes can free up after-tax cash flow and broaden long-term options. Yet each outcome depends on income levels, itemizing behavior, plan rules, and macro trends such as interest rate changes.

Explore more insights from New York Life Investments

More from New York Life Investments

-

Markets2 months ago

4 Things Investors Need to Know About AI

As AI adoption accelerates, investors are all asking the same question: where are the biggest opportunities?

-

Markets4 months ago

3 Factors Dragging Down the U.S. Dollar

The U.S. dollar is under pressure—but what’s driving the decline? Investors need to know.

-

Markets7 months ago

The Case for Active ETFs

Active ETFs are funds managed with the goal of beating the market—and they’re rapidly reshaping the asset management industry.

-

Economy9 months ago

Charting U.S. Trade Relationships

Maintaining a balanced perspective on trade is crucial. Which countries does the U.S. have the largest trade deficits and surpluses with?

-

Markets11 months ago

Trading Under Trump: Lessons from 2017-2021

With the second term of Trump underway, all eyes are on the markets to see how they react. Which sectors and regions that thrived last time?

-

Markets1 year ago

2024 in Review: Stock, Bond, and Real Estate Performance

How did equities, fixed income, and real estate (and their underlying sectors) perform in the U.S. throughout 2024?

-

Money1 year ago

Investing in an Era of an Aging Population

The U.S. population is aging. By 2070, the number of people over 65 will outnumber children. How can investors prepare?

-

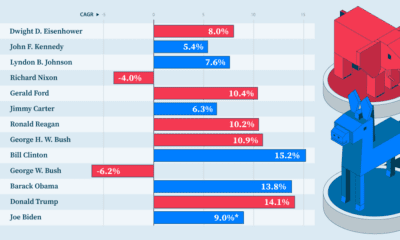

Politics1 year ago

Does it Matter to the Market Who Wins the White House?

After the president takes office, how have the market and the economy performed under Democrats vs Republicans?

-

Markets2 years ago

Magnificent 7 Mania: Why Diversification Still Matters

The Magnificent Seven stocks all outperformed the S&P 500 in 2023. However, it’s crucial to remember that diversifying a portfolio at both the company level and…

-

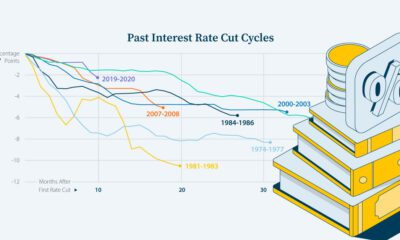

Markets2 years ago

What History Reveals About Interest Rate Cuts

How have previous cycles of interest rate cuts in the U.S. impacted the economy and financial markets?

-

Markets2 years ago

Beyond Big Names: The Case for Small- and Mid-Cap Stocks

Small- and mid-cap stocks have historically outperformed large caps. What are the opportunities and risks to consider?

-

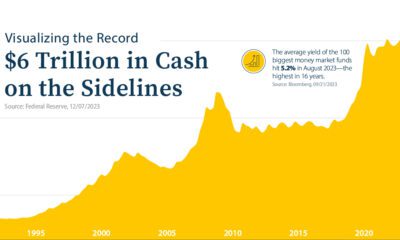

Markets2 years ago

Visualizing the Record $6 Trillion in Cash on the Sidelines

Assets in money market funds are at all-time highs. But as investors stockpile cash, are they missing out on today’s stock market rally?

-

Markets2 years ago

What Drove Market Volatility in 2023?

Market volatility is often considered a gauge for investor fear. How did investors react as the economic climate evolved in 2023?

-

Markets2 years ago

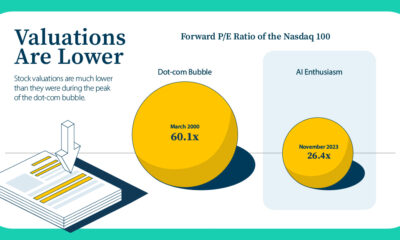

3 Reasons Why AI Enthusiasm Differs from the Dot-Com Bubble

Valuations are much lower than they were during the dot-com bubble, but what else sets the current AI enthusiasm apart?

-

Investor Education2 years ago

Paying Less Tax: The Tax-Loss Harvesting Advantage

Learn how tax-loss harvesting works by using capital losses to offset capital gains, potentially reducing your tax bill.

-

Markets2 years ago

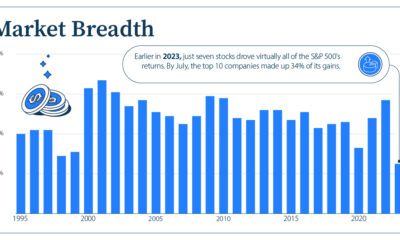

What’s Driving U.S. Stock Market Returns?

The performance of the S&P 500 has been strong so far in 2023. But what is fueling these stock market returns?

-

Markets2 years ago

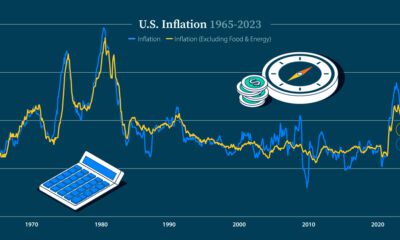

Decoding the Economics of a Soft Landing

Will the Federal Reserve achieve a soft landing? Here are key factors that play an important role in the direction of the U.S. economy.

-

Markets2 years ago

3 Reasons to Explore International Stocks Now

International stocks are trading at 20-year lows relative to U.S. stocks, which could present attractive buying opportunities for investors.

-

Markets3 years ago

Fact or Fiction? Test Your Knowledge About Investing During a Recession

From sector performance to market recoveries, test your knowledge about investing during a recession with this interactive quiz.

-

Markets3 years ago

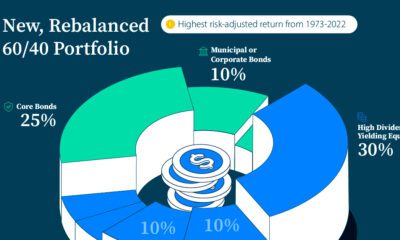

Reimagining the 60/40 Portfolio for Today’s Market

Amid uncertain economic times, a new allocation for the 60/40 portfolio may help investors target higher risk-adjusted returns.

-

Markets3 years ago

The Recession Playbook: Three Strategies for Investors

How can investors prepare for a market downturn? What goes into a recession investment strategy? We look at three sectors to consider.

-

Markets3 years ago

A Visual Guide to Bond Market Dynamics

What factors impact the bond market? Here’s how current interest rates, bond returns, and market volatility compare in a historical context.

-

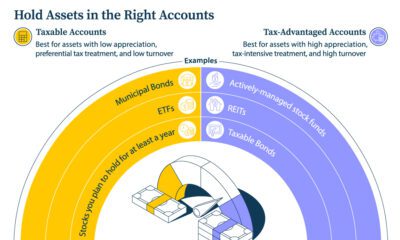

Investor Education3 years ago

5 Tax Tips for Investors

Learn five tax tips that may help maximize the after-tax value of your investments, including which assets may be best for certain accounts.

-

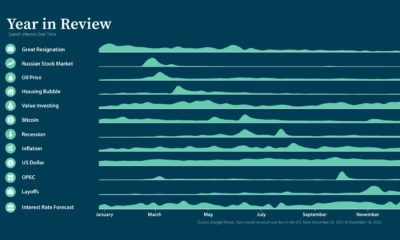

Markets3 years ago

The Top Google Searches Related to Investing in 2022

What was on investors’ minds in 2022? Discover the top Google searches and how the dominant trends played out in portfolios.

Subscribe

Please enable JavaScript in your browser to complete this form.Join 375,000+ email subscribers: *Sign Up