Submitted by John Rubino via DollarCollapse.com,

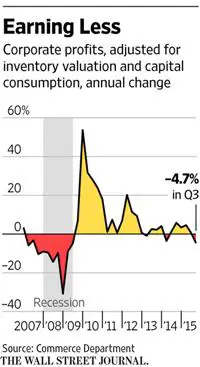

If 2015 was the year in which no investment strategy worked, 2016 is looking like the year in which all economic policies fail. Already, at what should be the blow-off peak of a long expansion, US corporate profits are instead rolling over:

In recent quarterly reports, most companies blame their dimming fortunes on the strong dollar’s impact on foreign sales, an assertion that’s borne out by recent declines in industrial production. We’re selling less real stuff abroad, so factories are making less:

[image]https://dollarcollapse.com/wp-content/uploads/2016/01/US-industrial-production-Jan-16.jpg[/image]

The huge bright spot in an otherwise bleak manufacturing landscape is auto sales, which have snapped back nicely:

[image]https://dollarcollapse.com/wp-content/uploads/2016/01/Car-sales-graph-Jan-16.jpg[/image]

But they’ve apparently been floating on a tide of extremely easy credit. In 2010, fewer than a tenth of car loans were for more than six years. Today the average loan is nearly that long. During the same expansion, outstanding auto credit rose from $600 billion to over a trillion. Car buyers are now challenging college students for the title of most clueless borrower. So expect all those breathless accounts of the bulletproof US auto market to be replaced with laments about empty showrooms in the near future.

[image]https://dollarcollapse.com/wp-content/uploads/2016/01/Car-loans.jpg[/image]

Add it all up and you get an economy that’s carrying some serious weight on its shoulders and rapidly losing momentum. Here’s the Atlanta Fed’s latest GDP Now reading, which puts Q4 growth at less than 1.5%:

[image]https://dollarcollapse.com/wp-content/uploads/2016/01/GDP-Now-Jan-16.jpg[/image]

None of which is especially noteworthy. Expansions usually start to look like this after six or seven years, especially those fueled by subprime lending.

What is noteworthy that these trends are playing out in an environment when all the other major economies are also rolling over and the US Fed has just begun a tightening cycle. That makes 2016 a uniquely scary year.