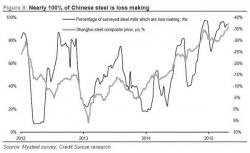

Chinese State Firms' Debt Hits New All Time High, As Profits Tumble

Overnight China's finance ministry reported the latest data on state-owned firms profitability. At a cumulative CNY 2.04 trillion (or $316 billion) for the January-November period, this was another nearly double digit decline, or -9.5% from the year ago period, following a -9.8% drop for the 10 month period the month before.