Asian Stocks Hit 18 Month High; Europe, US Futures Bounce As Dollar Rises

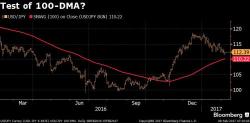

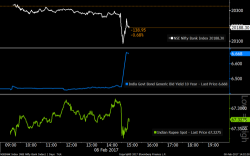

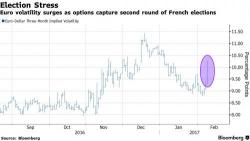

Asian stocks hit their highest level in 18 months, with positive momentum lifting European shares which were helped by Societe Generale earnings. Yields fell on some of the euro zone's battered low-rated bonds as investors put aside the political risks that have dominated markets this week. After trading flat, S&P futures bounced as US traders walked boosted by a spike in the USDJPY, ahead of earnings reports from Coca-Cola, Reynolds American, CVS Health, Nvidia and Twitter.