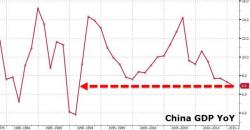

Equities Soar, Oil Back Over $30 On Hopes For More Stimulus Following Disturbing Chinese Data

Only the most intellectually dishonest can claim that last night's Chinese economic data deluge was anything but miserable. As we showed last night, everything missed:

- Industrial Production +5.9% (MISS vs +6.0% YoY expectations)

- Retail Sales +11.1% (MISS vs +11.3% YoY expectations)

- Fixed Asset Investment +10.0% (MISS vs +10.2% YoY expectations),

- Q4 GDP growth +6.8% (MISS vs +6.9% YoY expectations).

Even as the real full year GDP of 6.9% was in line, it was still the lowest since 1990...