All Eyes On Yellen: Global Markets Flat On Dreadful Volumes, Oil Slides

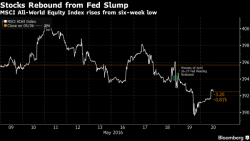

In a world where fundamentals don't matter, everyone's attention will be on Janet Yellen who speaks at 1:15pm today in Harvard, hoping to glean some more hints about the Fed's intentionas and next steps, including a possible rate hike in June or July. And with a long holiday in both the US and UK (US bond market closes at 2pm today), it is no surprise overnight trading volumes have been dreadful, helping keep global equities poised for the highest close in three weeks; this won't change unless Yellen says something that would disrupt the calm that’s settled over financial markets.