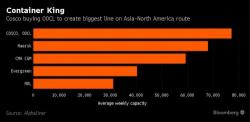

China Creates Pacific Shipping Giant With Cosco's Orient Takeover

The Baltic Dry Index has retraced most of its 55% surge from March, yet the mild recovery in shipping fees since early last year appears to have revived appetite for a renewed wave of consolidation in the shipping space.