European, Asian Stocks Slide But US Futures Rebound As Tax Deal Fears Ease

U.S. equity index futures point to a higher open, having rebounded some 10 points off session lows with the VIX stuck on the edge between single and double digits, while European and Asian shares decline as investors assess central banks’ shift toward tighter monetary policy and concern over tax overhaul ahead of final plan.

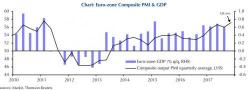

It has been a groggy end to what is still set to be a third week of gains for MSCI’s global stock index following more upbeat data and signs that central banks including the Federal Reserve will keep treading carefully with interest rate hikes.