Futures, Oil Dip On Stronger Dollar Ahead Of "Hawkish" Yellen Speech

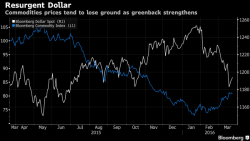

With Europe back from Easter break, we are seeing a modest continuation of the dollar strength witnessed every day last week, which in turn is pressuring oil and the commodity complex, and leading to some selling in US equity futures (down 0.2% to 2024) ahead of today's main event which is Janet Yellen's speech as the Economic Club of New York at 12:20pm, an event which judging by risk assets so far is expected to be far more hawkish than dovish: after all the S&P 500 is north of 2,000 for now.