The China-Panic Trade Is Back

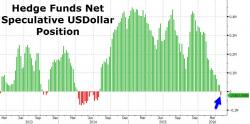

Once again the fears over China's slowdown, global growth faltering, and the fallacy of US analyst hockey sticks are biting at the ankles of fiction-peddling talking heads. With copper plunging and the USD Index resurgent, as Bloomberg's Mark Cudmore warns, the risk-aversion sparked by China in January is on course for an imminent replay...

Deja vu all over again...

With the last few weeks really diverging...