Is Something Starting To Break? Stocks Plummet And Bonds Go Nuts As Economic Data Disappoints

Published

32 mins ago

on

April 25, 2024

| 33 views

-->

By

Jenna Ross

Graphics & Design

![]()

See this visualization first on the Voronoi app.

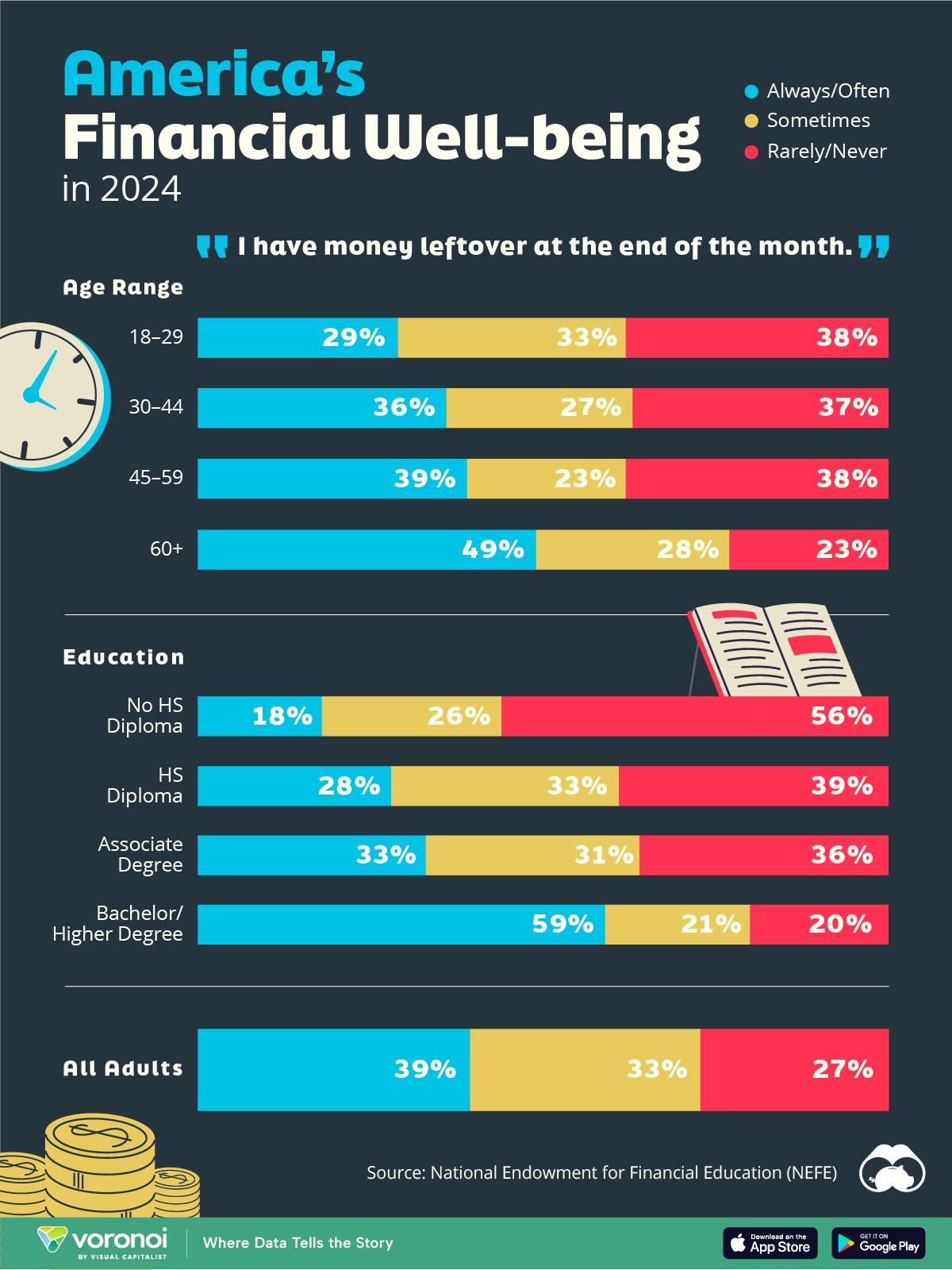

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

This article was written by Brandon Smith and originally published at Prepper All-Naturals

One of the more difficult aspects of working in economic analysis is the problem of rampant disinformation that you have to dig through in order to get to the truth of any particular issue. In this regard, economics is very similar to politics. The propaganda is endless and debunking it sometimes feels like moving a mountain with a teaspoon.