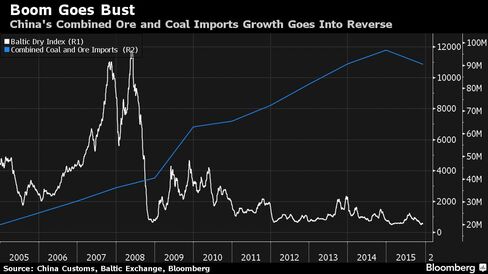

China 'Stealth' Devaluation Continues - Yuan Plunges For 6th Day, Default Risk Soars, Fosun Bonds Crash

USDCNY broke above 6.4500 for the first time since the August devaluation, extending its post-IMF plunge to 6 days. This is the largest and longest streak of weakness since March 2014 as China seems to have taken the SDR-inclusion as blessing to devalue its currency drip by drip. Default risk is once again stomping higher as CDS surge from 94bps to 112bps (2-month highs).