3 Things: Recession, Retail-less, Stupidity

Submitted by Lance Roberts via RealInvestmentAdvice.com,

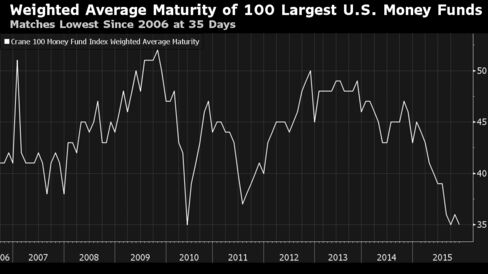

The Rising Risk Of A Recession

It is often said that one should never discuss religion or politics as you are going to wind up offending someone. In the financial world it is mentioning the “R” word.

The reason, of course, is that it is the onset of a recession that typically ends the “bull market” party. As the legendary Bob Farrell once stated: