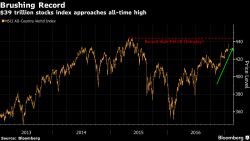

Global Stock Index On Verge Of All-Time High Propelled By "Dow 20,000" Euphoria

With global stock markets basking in the afterglow of Dow crossing 20,000 for the first time, on Thursday they propelled higher in sympathy with the US, as Asia and Europe are trading solidly in the green, as is the dollar which rebounded strongly off a 5 week low. Copper touched the highest price since November after reports of lower production. Global government bonds extended declines as France’s 10-year yield breached 1% for the first time in more than a year. Gold declined.