What Could Possibly Go Wrong With Tax Reform? The Answer, According To Goldman, Is "Plenty"

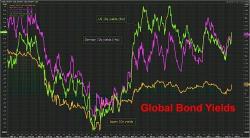

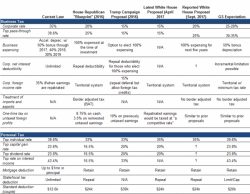

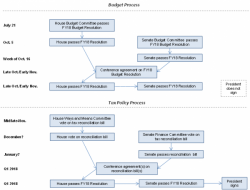

One of the reason why the torrid dollar rally of the past few weeks appears to have plateaued, at least for the time being, is that just like earlier in the year, doubts have emerged about the viability of the "new and improved" tax plan, which according to the Tax Policy Center would mostly benefit the "Top 1", even as it eventually pushes taxes for the upper middle class progressively higher.