Dear Dallas Fed, Any Comment?

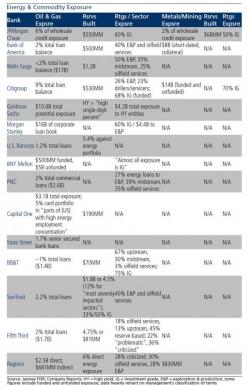

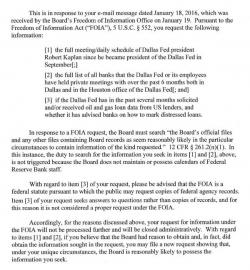

Several months ago, just as the market was tumbling on the back of crashing oil prices and not only energy companies but banks exposed to them via secured loans seemed in peril, we wrote a post titled "Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears" in which we made the following observations: