All Eyes On Draghi: Futures Flat, Euro Surges, Dollar Slides; Yuan Breaches 6.50

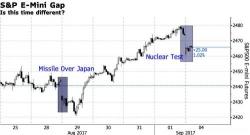

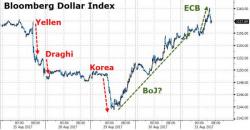

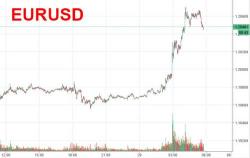

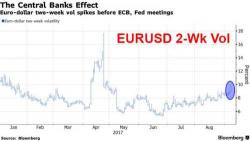

S&P futures are flat, still spooked by the WSJ's report that Gary Cohn will not be the next Fed chair, while both European stocks and Asian shares gain in a overnight session on edge in which everyone is looking forward to today's main risk event: the ECB meeting and Draghi press conference due in under two hours. The dollar continued to weaken against most G-10 peers as tensions over North Korea, concerns over Stan Fischer's resignation and the increasingly cloudy Fed outlook outweighed positive sentiment from the US debt ceiling extension.