Time To Buy US Treasury Bonds? Gold? Equities?

Submitted by Michael Shedlock via MishTalk.com,

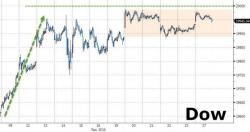

As we head into 2017, how should one be positioned? Let’s explore that idea with a trio of contrarian indicators.

US Treasuries?

The one idea most widely agreed upon is that Trump will spur inflation and treasuries are the last place to be.

This headline says it all.

The other day this was in @USATODAY pic.twitter.com/lgzCyW9BLM