Matt King Is Back With A Dire Warning: "A Significant Un-balancing Is Coming"

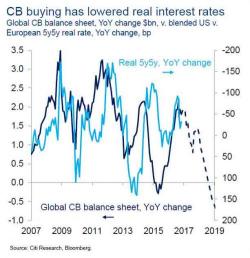

Earlier this week we discussed a chart from Citi's Hanz Lorenzen, which we said may be the "scariest chart for central banks" and showed the projected collapse in central bank "impulse" in coming years as a result of balance sheet contraction, and which - if history is any indication - would drag down not only future inflation but also risk assets. As Citi put it "the principal transmission channel to the real economy has been...