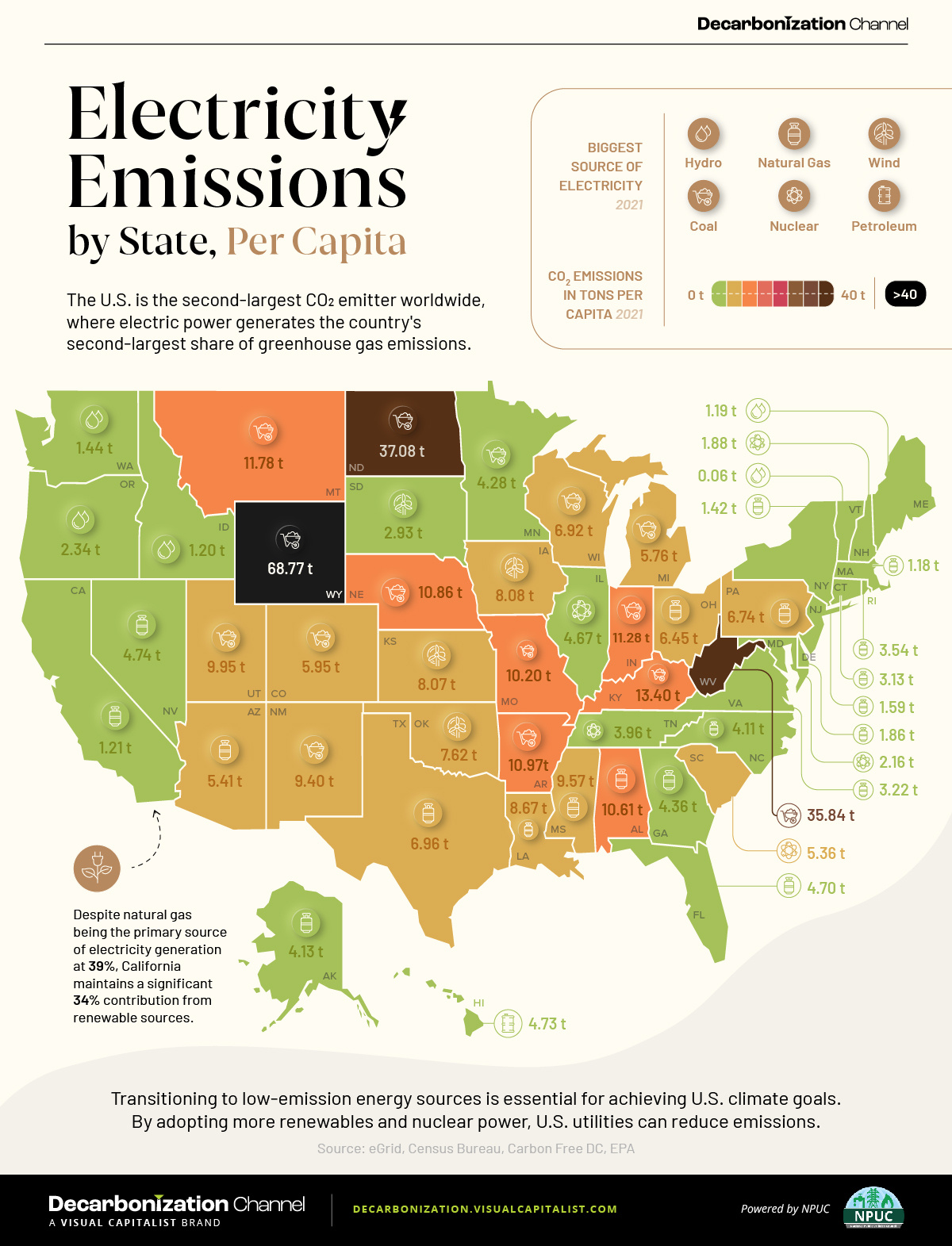

Visualized: Per Capita Electricity Emissions, by State

Subscribe to the Decarbonization Channel’s free mailing list for more like this

Per Capita Electricity Emissions by State

This was originally posted on the Decarbonization Channel. Subscribe to the free mailing list to be the first to see graphics related to decarbonization with a focus on the U.S. energy sector.