From "BTFD" To "Sell The Rip": Global Stocks Slide, Nikkei Tumbles, Pound Plunges

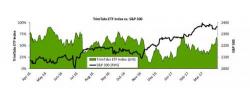

S&P futures gave up early gains and were trading down -0.2%, as Donald Trump completes his first Asian tour and as pressure mounts on U.K. Prime Minister Theresa May, sending the pound plunging. European stocks fell, tracking many Asian shares as the Nikkei plunge accelerated.