Frontrunning: February 16

- Oil eases off highs after output freeze agreement (Reuters)

- Saudis and Russia agree to oil output freeze, Iran still an obstacle (Reuters)

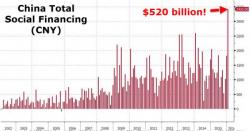

- China Loses Control of the Economic Story Line (WSJ)

- Obama starts work to pick Supreme Court justice amid political 'bluster' (Reuters)

- The Never-Ending Story: Europe’s Banks Face a Frightening Future (BBG)

- Apollo Global to buy security services company ADT for $7 billion (Reuters)

- Anglo Hastens Retreat From Coal, Iron Ore as Losses Double (BBG)

- Markets Putting Faith in QE4 (WSJ)