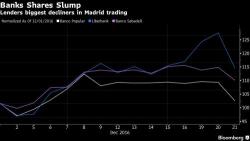

Dow At All Time High, Dollar Dips, Europe Lower Dragged By Sliding Spanish, Italian Banks

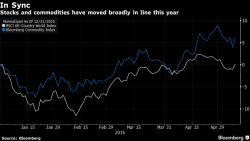

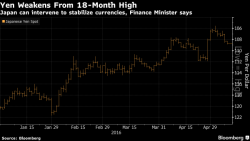

US equity futures and Asian stocks were unchanged while European stocks declined after touching the highest level in almost a year, as Italian and Spanish banks dragged indexes lower. The dollar eased back from 14-year highs as bond yields fell on Wednesday and oil extended its advance in increasingly thin trading.