Hilsenrath Just Reset Market Expectations: "Fed Is Worried Rates Will End Up Right Back At Zero"

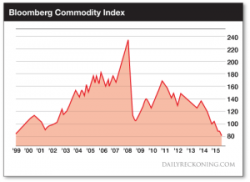

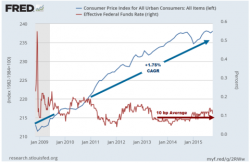

Two weeks ago, we predicted that if the same September storm clouds return, and if December, which is increasingly looking as shaky as August as a result of a return of China deval fears, soaring dollar concerns and - the cherry on top - the collapse in junk bonds, forcing the Fed to have some literally last minute concerns about a rate hike, then the Fed's official mouthpiece, Jon Hilsenrath will be very busy...